This Week in Apps #109 - Off to a Weird Start...

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

US Revenue Index (30 Day)

Insights

1. The Highest Earning Apps in March

This week I crunched the numbers and ranked the highest-earning apps in the US. I ranked downloads last week, in case you missed it.

TikTok was the highest-earning app in March, which is what I expect will be the case in months to come. It ended March richer than February, adding $62M of net revenue from the US to its bottom line, according to our estimates. Nearly 20% higher than February!

YouTube was right behind with $49M in net revenue from the US, which is higher than February but only by a bit. I've been comparing these two in terms of revenue but, it's worth remembering that in-app purchases serve different purposes for the two. And TikTok's case has a much more direct correlation to demand than YouTube's.

Something to keep in mind.

Streaming and dating apps fill up the rest of the spots in our top 10 round-up, which resembles February a lot, albeit with higher numbers.

Together, the top 10 highest earning apps brought in $318M of net revenue in March from the US, according to our estimates. This total is about 10% higher than that of February, and all apps on our list have seen an increase in revenue without exception.

2. The Highest Earning Games in March

Remember how game revenue was surprisingly low in February? This week I crunched the numbers and ranked the highest earning games in the US to see if February was a trend or a fluke.

Leading the pack is Roblox, which has been in the lead for quite some time now. It ended March with $76M of net revenue from the App Store and Google Play in the US, according to our estimates. March saw an increase across both stores.

Behind it is Candy Crush, which our estimates put at $59M of net revenue in the US. Although Candy Crush ended February in the same spot, this total is significantly higher. And by significant, I mean $11M higher.

And it's not just Candy Crush that saw big gains in March. All other games on the list saw increases in the millions in March. All except for Genshin Impact, which didn't make the list this month. Instead, Evony, not a hyper-casual game, snuck in with $16M of net revenue split fairly evenly between the App Store and Google Play

Together, the top 10 highest earning games brought in $316M of net revenue in March from the US, according to our estimates. If you're comparing, that's a significant increase over February. Like downloads, which rose a ton in March, so did revenue.

3. What's With These Widgets Going Viral???

Another week, another widget shooting to the top of the App Store. Wait, I definitely said that recently. Yes, yes I did...

Well, it's happening again.

LiveIn, a home screen widget that lets your friends share pictures, has taken over the US App Store.

Downloads across the App Store and Google Play, which averaged just 3,000 per day in March, according to our estimates, jumped to nearly 160,000 on Tuesday. Up nearly 2,500% within a few weeks. That's a lot for a widget that's only a few months old.

The US had the most downloads, but Saudi Arabia was right behind it, with Brazil and India in 3rd and 4th places.

LiveIn's widget idea isn't novel. A few months ago, LocketWidget rose to the top of the App Store, doing exactly the same thing. I looked at LiveIn's release date and guess what? It came a few weeks after LocketWidget hit peak downloads.

Coincidence? I think not. Inspiration? That's more like it. Since taking off in early January, LocketWidget was downloaded more than 11,000,000 times from the App Store, according to our App Intelligence. And that's after it lost its top spot.

LiveIn's rise is a reminder you don't have to be the first to an idea to be successful. It doesn't mean LiveIn will be successful, but for now, the opportunity is there.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. CNN Joins the Streaming Race, But Slower Than Expected

After lots of talk and preparation, CNN finally launched a paid/premium streaming tier into its mobile apps this month.

There was a lot of hype and speculation about CNN+ before it launched, so now that we have a week of data, let's see how it performed.

CNN+, a $5.99/mo. subscription, has been added to CNN's mobile app on the App Store and Google Play as an in-app purchase, which means we can use our App Intelligence to back out new subscribers.

Our estimates show that since the in-app purchase was added, CNN earned a total of $35,000 of gross revenue from the App Store and Google Play, with the lion's share of revenue coming from the App Store.

Dividing the total revenue and the subscription cost gives us a little over 5,800 mobile subscribers in the app's first week.

This is a rough calculation, so the number is likely a bit higher because the app offers a free 7-day trial and also a lower cost for paying annually. But it's not off by that much.

Was that the performance CNN was hoping for? Not really. A great reminder that the streaming race is not just about brand recognition but really is about content. When content within the CNN+ section of the app becomes engaging enough, more people will subscribe. Much like when a new movie is released on HBO Max or Disney+

Speaking of those two - they have something CNN doesn't. Downloads.

Downloads, which aren't exclusive to CNN+ because it lives within the main CNN app, have decreased a bit in April. Just kidding, they were down by a lot! 56% from the same period in March for a difference of roughly 100,000 downloads, according to our estimates.

To me that says the current CNN+ subscribers are people who already had the app and are users. Not new users that were attracted to CNN+

That's both good and bad, but in the long term, that's just bad, so I expect to see more content going into the free side of the CNN app in the near future to get more traction. Specifically, traction that isn't only fueled by current events.

A challenge for a news app, but it's not impossible.

5. TikTok's Takes Aim at a Very Lucrative Industry

I've been talking about CapCut quite a bit. And with reason. CapCut is a newcomer into the lucrative video editor space.

The video editor space has seen significant year-over-year revenue growth and in a way, is the direct result of CapCut's parent, TikTok's success.

So it'd make sense TikTok would want to dominate it. But what would that mean for the 5,000+ apps in this space?

Well, the easy answer is quite a lot of money!

To get an idea of how big the video editor market is, I added up revenue estimates for all apps that have the term "video editor" in their name across the App Store and Google Play, which added up to a little over 5,000 apps.

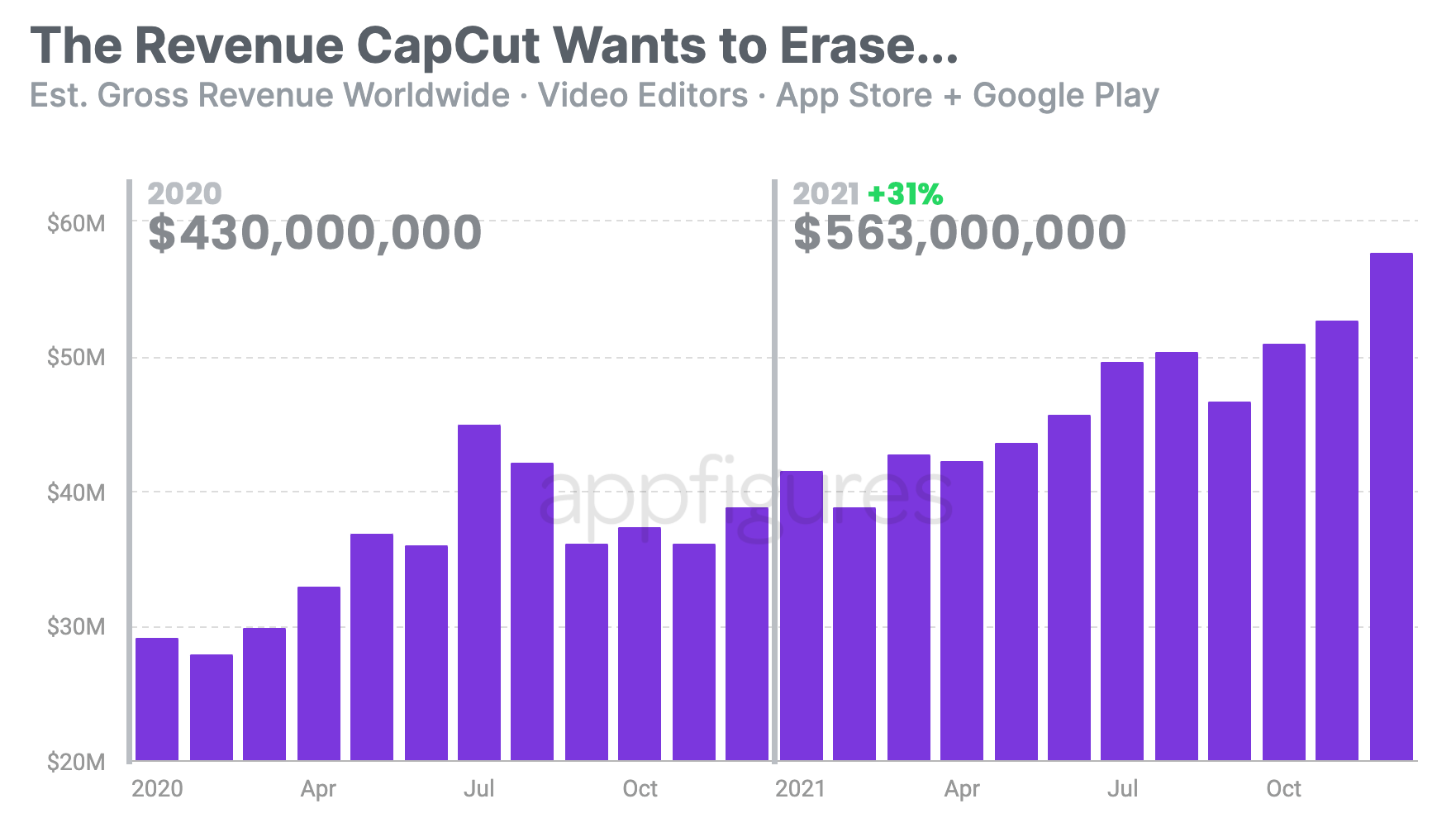

Looking at the revenue over time, one thing is very obvious – it's growing, and fast!

Gross revenue, which our estimates put at around $430M in 2020, grew by more than 30% to $563M in 2021. For more context, the revenue in January 2020 was $29M. And in December of 2021, it was $58M, according to our estimates.

It gets a bit more complicated when you dig into the distribution, where you see that about half of that revenue comes from the very top 5-6 apps.

Clearly, CapCut can really do some damage there, and when I analyze 2022, later in the year, I'm sure we'll be able to see it.

CapCut has the users (through TikTok) and is free, which is an unparalleled advantage. But... does it have the features?

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.