This Week in Apps - Everyone's Taking on Instagram

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

Insights

1. TikTok's Parent ByteDance Really Wants to Take Over the US

TikTok seems to be winning the ban war right now, but while most people are paying attention to that, ByteDance, TikTok's parent company is making another push in the US and taking on another big platform.

TikTok's new sibling is Lemon8, a competitor to Instagram and Pinterest, as some TikTokers are calling it, and feels a bit like a way for influencers to sell or promote products.

The app itself launched right into covid, in March of 2020, but didn't make it to the US until this week.

Lemon8, which is published by a company name that isn't ByteDance but really is ByteDance under the hood, rolled out on Monday and managed to climb to the top of its category by Tuesday morning.

It also managed to crack the top 10 overall in the US App Store, but couldn't hold the spot for more than 3 hours.

In terms of downloads, we estimate that Lemon8's US release added 130K iOS users between Monday and Wednesday, making Tuesday Lemon8's biggest day of downloads since release and the US the top country during those three days.

Of the 12 million downloads we estimate Lemon8 saw from the App Store since 2020, 40%, or roughly 5M downloads, came from Japan and 37%, or 4.4M, came from Indonesia.

These aren't exactly TikTok numbers, but that's because ByteDance is experimenting. For example, Lemon8 tried launching in China but it didn't work out. Stiff competition from incumbents led to the app being removed from the App Store very quickly.

Another reason why I don't think ByteDance is going full ham yet is that this launch was not assisted by Apple Search Ads, a strategy that's very common these days. Instead, Lemon8 paid TikTokers to promote the new app, and given the low downloads, I imagine even that campaign was very small.

I expect to see Lemon8 rising and becoming a headache for Instagram and possibly Pinterest, given how big the opportunity for influencer sales is and how little competition there is.

I also expect to see some serious spend on Apple Search Ads in the future.

2. Hipstamatic (Re)Launches a Classic to Challenge Instagram Culture

If you've been around apps for long enough, and in this case, I really mean a loooong time, you probably remember Hipstamatic.

In case you don't, Hipstamatic was an App Store sweetheart back in the early 2010s, being the most popular camera app to sell filters. It dominated the App Store and made subscription-level revenue even though subscriptions didn't even exist.

But then Instagram came out and Hipstamatic spiraled out of control, losing all momentum and popularity.

Last week, Hipstamatic relaunched as a pure way to take pictures, taking clear aim at Instagram.

I'm a hopeless romantic, so I really wanted this relaunch to be a huge success. I even subscribed as a paid user.

But...

Hipstamatic's relaunch wasn't met with roaring demand. At all.

According to our estimates, the new Hipstamatic app was downloaded just 16K times, earning under $5K in net revenue from the App Store. That's not how it will take on Instagram or the culture Instagram created.

Not only is this total tiny, the trend, overall, isn't really growing. Downloads peaked last Thursday with more than 5K downloads but dipped into the hundreds fairly quickly after.

If you're in the business of apps, you can learn a few interesting things from this launch:

- Hipstamatic is only available on the App Store. That may have been a cool selling point 10 years ago, but these days it's less about the platform and more about the users. Going App Store only, especially for an app that connects people, is a big limiter for growth.

- The app's UX is really confusing. It feels like the experience is complicated on purpose, and that's not a positive. It took me a while to figure out how to work it, and it's only a camera so that shouldn't be the case.

- The app doesn't feel native even though it is, I checked. The interactions are slow and the animations are sluggish.

- And the most important bit, the monetization structure feels a bit forced and unwelcoming.

I consider all of these to be mistakes. The kind that prevent growth. They can all be fixed with some/a lot of effort, but if you're starting from scratch in 2023 you shouldn't really have any of these in v1.

Let's see if Hipstamatic can fix these.

I remember reading a great case study about all the mistakes that ultimately killed Hipstamatic. I couldn't find it but if you happen to know what I'm talking about and have a link please send it my way and I'll share it next week. It's a must-read for anyone building a business.

3. Why Did Lyft Shift Away from its Founders to a Hired CEO?

Earlier in the week, Uber's chief rival, Lyft, announced it's replacing its founders with a new CEO.

A founder stepping down usually means trouble, or a mega exit. Looking at demand, aka downloads, this case is more of the former and none of the latter.

Uber is the leader in rides. Has been for quite a while, and even through the rough patch and ultimately its founder being replaced by a hired CEO, Uber still managed to maintain the lead over Lyft.

When covid locked down the country both Uber and Lyft suffered, but like most other IRL apps, both recovered at some point last year. But unlike Uber, which not just recovered but also saw downloads grow by multiple millions, Lyft's didn't grow as much.

According to our estimates, Uber added 8M and 7.7M new users in Q3 and Q4 of 2022 from the App Store and Google Play in the US.

Lyft added 5.3M and 5M users, respectively.

As we go through all the quarters, the trend is obvious, Lyft is far behind. Still growing, but not as fast.

FYI - I'm only looking at the US here because Uber is muuuch larger internationally.

But there's more which I think is even more important. Drivers.

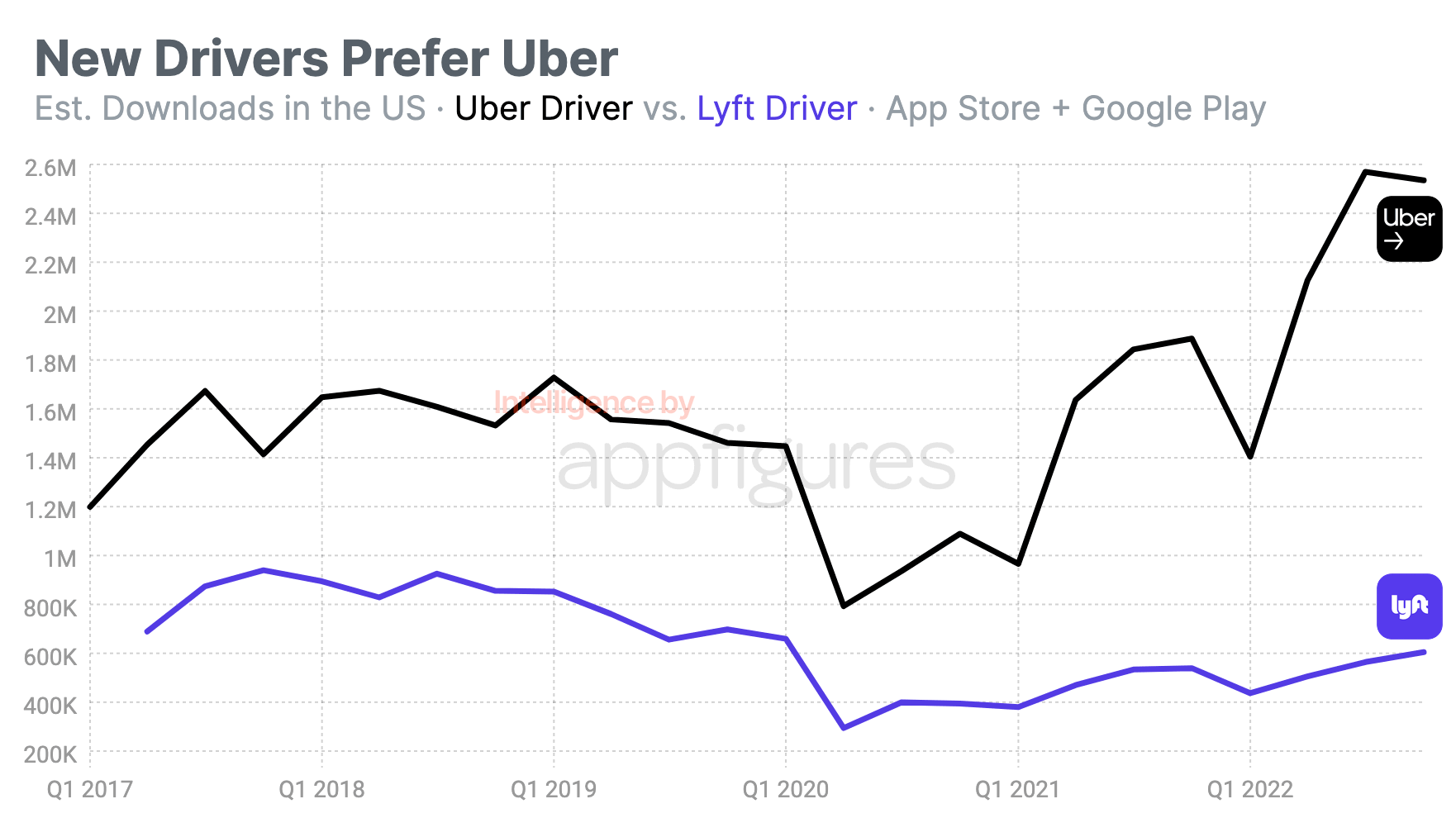

Looking at downloads of the driver companion apps from both, Lyft isn't the platform drivers want to drive for in a post-covid world.

Much like its growth in riders, Uber's driver side of the business also grew beyond its pre-covid numbers. The platform added 2.5M drivers in the US, based on app downloads, in Q3 and also in Q4, so a total of 5M new drivers, according to our estimates.

That's about two million more than Q3 and Q4 of 2019. A nice upward trend.

Lyft's trend was the opposite. A little more than a million drivers joined Lyft in Q3 and A4 of 2022, down from 1.3M in 2019. A small drop when looking at the numbers but a significant one when considering the direction of the trend.

Replacing a founder with a hired CEO is tough. I'm not saying hired CEOs can't do a good job, but for a founder, there's more to it than just doing a good job. Between reduced growth in demand and negative growth in drivers, however, Lyft's board had to make a tough decision.

Let's see what the new CEO can do to lift the numbers.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Apple Really Wants You to Listen to Classical Music!

Apple launched a new app this week. The first in a while.

Apple Music Classical does exactly what you would expect -- play classical music.

On its own, this release isn't really all that interesting or exciting. I like classical music just like the next guy, but I don't find myself needing an entire app just for it.

But...

What I did find interesting about this release is how quickly Apple Music Classical made it to the top of the downloads chart. And this is just me being funny. The app launched right into the #1 spot, dethroning long-term king Temu.

While I believe there is demand for such an app, I don't really see that much demand making me think this rank wasn't a result of demand... I could be wrong.

While Apple Music Classical managed to score the top spot in more than 40 countries, most downloads are currently coming from the US.

According to our estimates, Apple Music Classical was downloaded nearly a million times between Tuesday and Wednesday this week. And that's across all countries where it is available.

The majority of downloads, roughly 40% overall, came from the US, not a big surprise. The remaining 60(ish)% came from 90+ countries, including Bhutan, which sits at the very bottom of the list with 4 downloads.

Apple has always been aggressive with its Music app. It got in trouble for giving it an unfair advantage in search results just a few years ago. I hope this isn't the case again.

As a fun game, can you name one classical composer from each of these countries?

5. The Top AI Chatbots Are Earning Millions Right Now

OpenAI started an AI revolution with the release of ChatGPT. For some developers, the revolution is also earning millions.

I touched on how many developers are jumping on the AI chatbot wave and releasing "smart" apps to the App Store and Google Play last week and ended by saying that the top apps have earned more than a million dollars so far.

That was really just a quick statement and not a real analysis, and many have asked me to justify it, so I looked through the top chart in the US App Store right now and summed up the revenue of all AI chatbots that ranked in the top 50.

There are exactly four, and they include Kiyo, Genie, AI Chatbot, and Ask AI. The latter just started monetizing so I'm going to exclude it to keep things even.

Together, the trio earned $3M in net revenue from the App Store since the beginning of the year, according to our intelligence. That's quite a lot. In addition to that haul, the trend is also very positive for all three apps, which are averaging $20K - $30K in revenue every day. And that's net, meaning after paying Apple.

And all of that revenue is coming from subscriptions, meaning it'll continue to grow as AI continues to penetrate the mainstream.

If you're developing an AI chatbot right now make sure to do all of your optimizations ahead of time. By that I mean research your initial set of keywords for the name/subtitle/keyword list (or short/long description for Google), figure out what you want to/can spend on paid ads to kickstart it, and make sure your app is optimized to convert downloads into ratings.

Doing this ahead of your launch could make the difference between the app succeeding and the app drowning in the sea of chatbots that are making their way into the stores.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.