This Week in Apps - A Game Grab

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 day ago)

Insights

1. The Most Downloaded Games in the World

I crunched the numbers and ranked the most downloaded mobile games in the world and wow, September was a very active month with lots of winners and losers.

Subway Surfers was the most downloaded mobile game in the world in September. We estimate the long-running champ saw 17M downloads, beating hyper-casual My Perfect Hotel by just a million downloads. That's actually pretty massive for a hyper-casual title.

The majority of My Perfect Hotel's downloads came from Google Play, which is exactly what you'd expect, but the title also made it to the #2 spot on the App Store, which is impressive.

Roblox, Build a Queen, and Royal Match round out the top 5 mobile games in September.

Ready for all the changes? All you need to do is look at the App Store's chart for the month.

Every app, with one exception, moved!

Lots of Movement

Royal Match, Subway Surfers, and Roblox all climbed when compared to August. High Energy Heroes (translated), a China-only title that's joining the wave I highlighted last month, propelled into the 6th spot in September with 2M downloads from the App Store, according to our estimates.

Happy Match Cafe and Retro Bowl College made the list for the first time, and my one of my personal favorites, 8 Ball Pool, made the list for the first time in a long time.

The App Store has been very dynamic for quite some time now, but this is one of the most dynamic months in memory. All of these titles are being pushed heavily by ads, which might mean advertisers have finally figured out life post-ATT.

Google Play also had more fluctuations than expected, which reinforces the theory.

Together, the top 10 most downloaded mobile games in the world made their way into 125M devices in September, according to our estimates. That's a bunch lower than August, but that's to be expected with the summer ending and kids going back to school.

2. The Highest Earning Games in the World

I crunched the numbers and ranked the highest-earning mobile games in the world in September and remember last month's trend? Well, it's only getting stronger.

Monopoly Go wasn't the highest-earning mobile game in the world in September! King of Glory (translated), a China-only title that's incredibly popular in China. It ended September with $104M in net revenue from the App Store, according to our estimates. And that's net which means what's left after Apple takes its share.

Aaaaand, King of Glory is only available for download in China. This is big!

Monopoly Go was the second highest-earner, raking in a whopping $94M of net revenue from the App Store and Google Play in September, according to our estimates.

Monopoly Go's amazing growth has slowed down a bit in September, which aligns with the end of summer. That's pretty much the trend across the entire list.

Royal Match, 和平精英 (Peace Elite), and Candy Crush round out the top 5 highest-earning mobile games in the world in September. This is the second month with 2 China-only titles at the top. I expect to see more of that in the future.

Another interesting change - Candy Crush has officially been dethroned.

Together, the top 10 highest-earning mobile games brought in $626M of net revenue in September, according to our App intelligence. A whole lot less than August, but that's to be expected.

Although this total is lower, given what we've seen so far this year, I fully expect this year's holiday season to outperform last year.

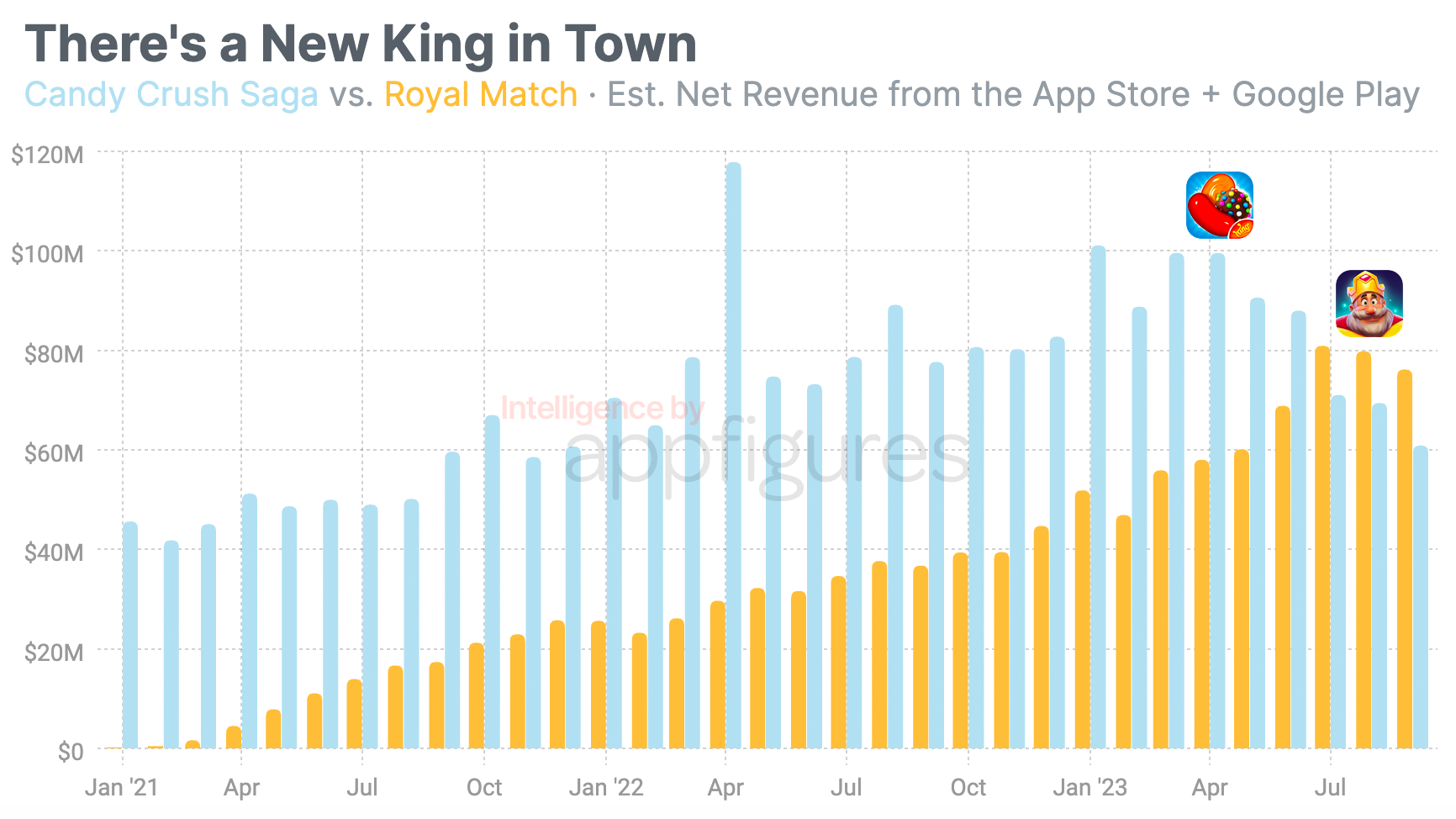

3. It's Official - Royal Match Dethroned Candy Crush!

Candy Crush has been crushing it for so long that it seemed like it will always continue to be the leader of the match-3 category.

But after many years in #1, the king's run has come to an end.

For three months now, a new competitor has been beating Candy Crush in new downloads and revenue!

The competitor is Royal Match, a match-3 game that launched in the summer of 2020.

Royal Match came out of the gate swinging. In January of 2021, the game brought in $208M of net revenue from the App Store and Google Play, according to our estimates. By January of 2022, that total balooned to $26M - and that's all net which is what's left after Apple and Google take their fees.

The game's meteoric revenue rise continued into 2023. Our App Intelligence shows that in January of 2023, Royal Match earned $52M of net revenue. Talk about growth!

January wasn't even Royal Match's best month. That award goes to July of 2023, where Royal Match earned a whopping $81M of net revenue.

The amazing revenue growth of Royal Match is best looked at by year:

- 2021: $144M

- 2022: $401M (+178%)

- 2023 (up to 10/13): $617M (+54%)

That means Royal Match has earned more in partial 2023 than in all of 2022 and 2021 combined. Between 2021 and October of 2023, Royal Match's revenue grew by 329%!

And while all of that was going on, Candy Crush also grew and even managed to get $30M shy of a billion dollars in 2022!

But 2023 hasn't been as full of growth as previous years.

More competition and a lack of updates is making it harder for the 12-year-old game to grow. Sprinkle challenges caused by Apple's App Tracking Transparency and the results are hard to accept.

So far this year, comparing June to September, Candy Crush's revenue dropped by 30%. That's a massive decline for a game that's been generally following a positive growth trend.

You might be thinking, "but Candy Crush is super old. Everyone has it already!", right? Well, that line of questioning is relevant when we look at demand which we can measure with downloads.

If everyone had Candy Crush no one would need to download it from the App Store or Google Play so those would go to 0 - but in September the game saw 9M new downloads...

For now, I think it's safe to say Royal Match is the king of match-3 games. But... Microsoft recently finished its acquisition of Activision Blizzard, bringing Candy Crush to Microsoft. And Microsoft already mentioned it's committed to growing the brand.

Candy Crush is a giant that won't go down quietly so it's not a question of if Candy Crush will return to its throw but rather when.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Genshin Impact Turns 3 - China Drives Growth

Genshin Impact turned 3 a few days ago and wow, time just flies. It feels like just yesterday the title launched to more than 8M downloads in its first 10 days of being out.

Fast forward 3 years and more than 70 updates across 3 versions and that 8 grew a lot.

If you're unfamiliar with the game, Genshin Impact is a free-to-play role-playing game where the player is a traveler looking for a lost sibling across the game's map. In-app purchases let players buy the game's own currency which can then be used to buy characters and weapons.

How Are the Downloads?

Since release, Genshin Impact saw 142M downloads, according to our estimates. The majority came in 2022, which was Genshin Impact's best year across the board!

In more absolute terms, Genshin Impact saw 45.3M downloads in 2022, according to our estimates. That total was 7% higher than downloads in 2021.

2023 is off to a good start but is unlikely to beat 2022's numbers. The game averaged 11M downloads per quarter in 2022 vs 10M in 2023. A small drop in percent but a big one in absolute numbers.

China is responsible for 20% of the game's downloads followed by the US and Russia, with 11% and 8% share, respectively. And keep in mind, Genshin Impact has a dedicated app for China and all the data in this analysis combines that version and the international version.

All 100 countries covered by our App Intelligence show some downloads for the title.

Like most very popular games, downloads are split fairly evenly between the App Store and Google Play, but Google Play is responsible for a tad more than half of the total downloads for Genshin Impact. 55% vs 45% for the App Store.

Let's Talk Turkey!

When it comes to revenue, get ready for a new suffix - Since release, Genshin Impact collected $1.8B of net revenue from the App Store and Google Play, according to our estimates. And like downloads, Genshin Impact's biggest year of revenue was 2022.

Our estimates show that in 2022, Genshin Impact earned $638M of net revenue from the App Store and Google Play, including from China. And this is net which is what MiHoYo gets to keep after Apple and Google take their fees.

Although Q1 of 2023 was the game's highest quarter of revenue the rest of 2023 seems to be dipping, suggesting that just like downloads, 2023 won't be as big as 2022 overall.

With so much new competition, challenges with advertising, restrictions in China, and the more dynamic nature of the App Store, this isn't a big surprise.

In terms of geography, China is also the biggest spender, contributing more than 35% to Genshin Impact's mobile revenue. The US and Japan followed with 24% and 16%, respectively.

But just like downloads, all 100 countries we cover with our estimates show revenue for the game.

The App Store was responsible for 67%, or $1.2B, of the game's net revenue. Although Google Play is usually the bigger contributor of downloads, more revenue almost always comes from the App Store. And this is no exception.

MiHoYo, the game's developer, has been very active in keeping the updates rolling with new maps, characters, and events to keep engagement. When following the trends, you can tell both revenue and downloads go up following the rollouts.

5. Niantic's Monster Hunter Now Hit 5M Downloads - Where's the Revenue?

Monster Hunter Now has been live for just about a month and already been downloaded more than 5M times from the App Store and Google Play, according to our estimates.

The AR role playing game from Capcom and Niantic, the company that brought Pokemon Go to the world, follows many games like it by being free to play and offering in-app purchases for the game's currency which can then be used to buy characters and weapons.

5M downloads is a lot of downloads, but if you've been a reader for a while you know what I'm asking - Is it making any money?

Yes, yes it is!

Our estimates show that in its first month on the App Store and Google Play, Monster Hunter Now earned $21.5M of net revenue. And that's net which means what Niantic, the game's publisher, gets to keep after Apple and Google deduct their fees.

Revenue has been pretty consistent with a few spikes indicating we can continue to expect this level of revenue moving forward. The trend isn't growing a lot, but as with other games this year, revenue growth will hinge on updates and in-app events.

The App Store is responsible for the majority of the revenue - $16.5M vs. $5M from Google Play, which is pretty normal for games.

What's interesting is where the majority of money is coming from, and in the case of Monster Hunter Now, it's Japan!

Japan was responsible for 56% of the game's revenue in the first month - that's nearly $13M of net revenue.

The US wasn't second on the list, Hong Kong was, earning the title $3M of net revenue for a 15% share of the total. The US was 3rd, contributing 12%.

The release has been well received with nearly 300K ratings, 95% of which are positive. Off the stores, the game has been praised for its graphics and use of augmented reality. Niantic is a master of that, so I'm not surprised.

But... there's a lot of competition. The App Store and Google Play are getting more games that want attention that growth will rely on how well the game can evolve.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.