This Week in Apps - Pokémon's Sleeping Giant

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. Pokémon Sleep Turns Two - Are There Any Competitors Left?

When Pokémon Sleep rolled out, all the way back in 2023, I wondered how it would impact the sleep tracking segment.

Pokémon is such a popular name that it could easily steal all growth away from incumbents like Sleep Cycle and ShutEye. But at the same time, the Pokémon brand isn't universally recognized in its offerings and is primarily associated with games, rather than sleep trackers.

So it could go both ways.

Fast forward two years, and we have our answer. And while it's a bit complicated, what isn't is the revenue.

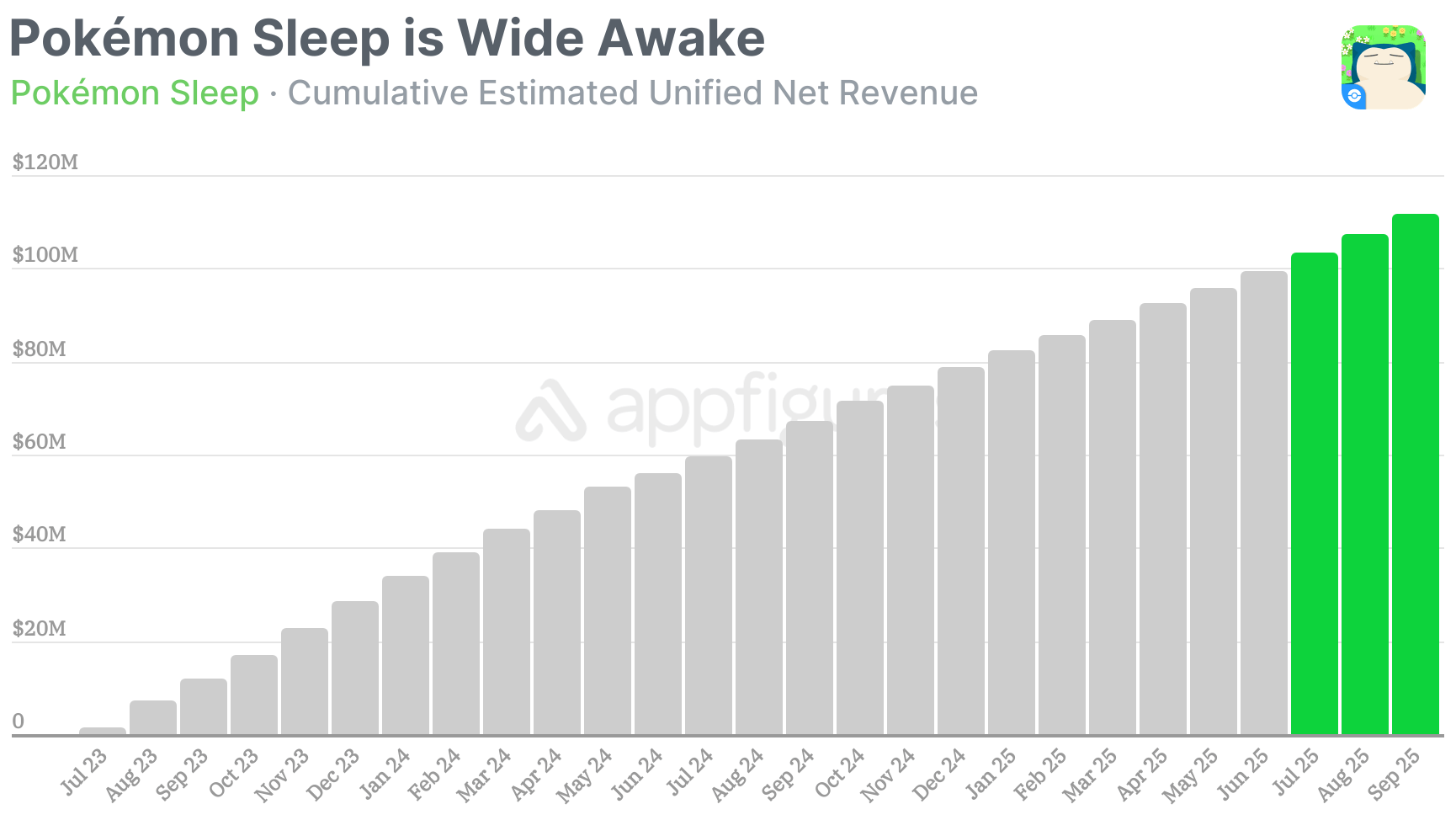

On its second birthday, this July, Pokémon Go crossed $100M total revenue for the first time. And in the two months since it added another $9M of net revenue (after fees) for a total of $112M since launch.

For context, Sleep Cycle earned $37M of net revenue at the same time, according to our estimates. If you're not familiar with the segment, Sleep Cycle was one of the first sleep trackers and the most popular at the time.

Before Pokémon Sleep's release, Sleep Cycle earned $1.3M of net revenue per month, according to our estimates. Now, it's earning about $1.1M after store fees. That's not the drop you'd expect after a big name like Pokémon steps in, but it makes sense.

Pokémon Sleep isn't competing over Sleep Cycle's audience for the most part. Instead, the app targets fans of the Pokémon franchise. So it didn't sherlock the segment but rather brought a new audience into it.

Although revenue growth has slowed ever since the app's release, Pokémon Sleep's revenue is far ahead of all competitors and has recently been rising, showing just how strong the brand is.

I'm sure there's a way competitors like Sleep Cycle can take advantage of this new audience, and I hope they are.

2. Just how Big is the Market for AI Avatars?

Everyone's talking about AI all the time now, but what you may not know is that a lot of people talk with AI these days, making apps like Character AI a real threat to dating apps.

That might sound a bit dramatic, but may not once we look at the numbers.

In case you're not familiar, Character AI offers AI avatars you can chat with. The avatars have different personalities,"from legendary heroes and mischievous villains to unhinged weirdos and loyal sidekicks" as the app's description says.

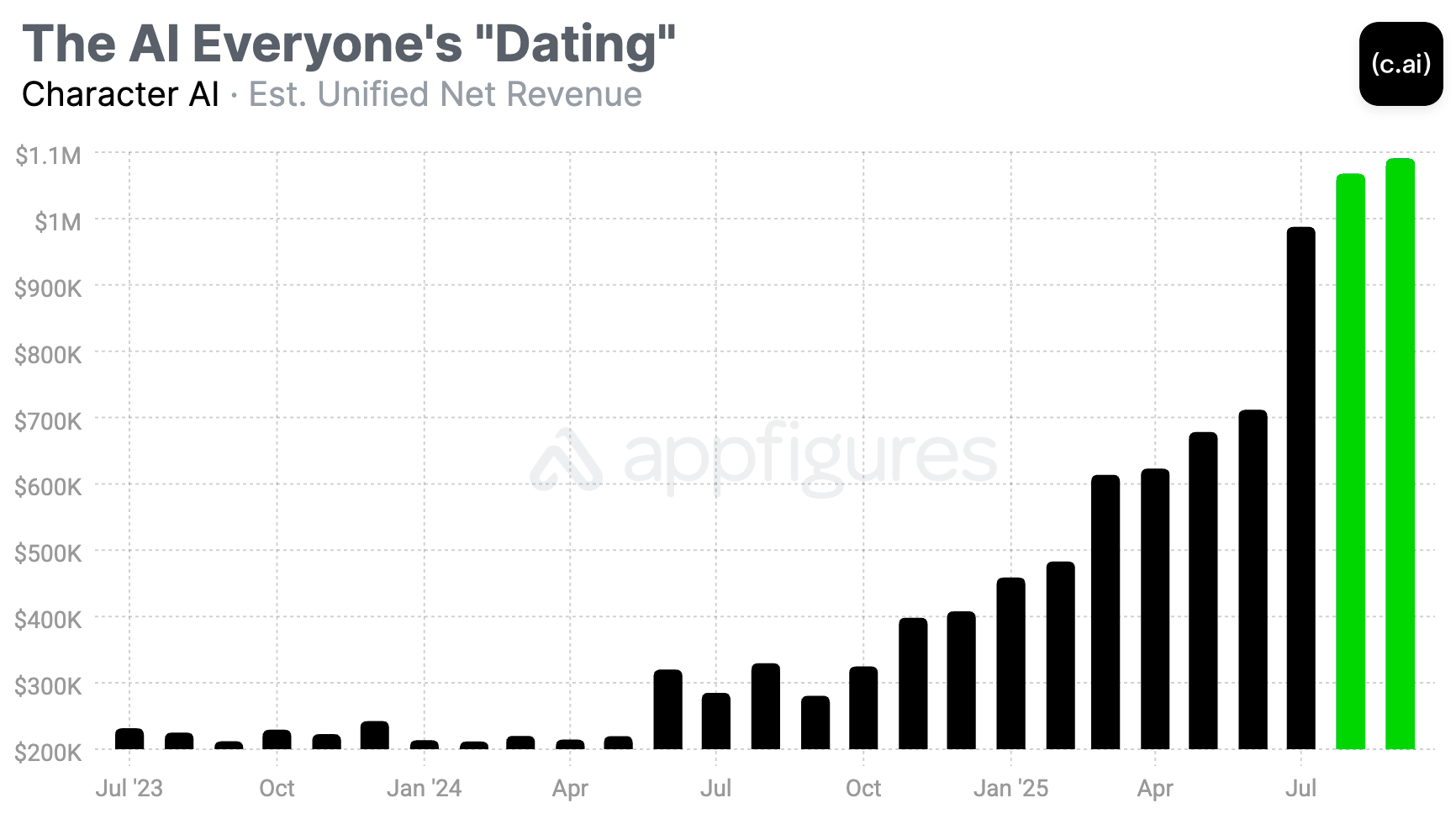

Just how big is the market for AI avatars? BIG!

According to our App Intelligence, Character AI's net revenue doubled so far this year, crossing $1M per month for the first time in August. And that's after store fees.

We estimate that since it was released, Character AI has earned a total of $11.5M in after-fee revenue from 57M downloads across the App Store and Google Play.

More than half of the revenue came from the US, but revenue from almost every other major country has been growing rapidly for the last year, indicating that it's spreading globally.

Should you go build an AI avatar right now? Probably not. 2023 is over. But new opportunities are popping up so often these days that the real question developers should be asking is "what should I build first". And the answer to that is all in the data.

See Appfigures In Action

Better intelligence to beat the competition faster!

3. Grok's Mobile Revenue Rose 119% in Q3

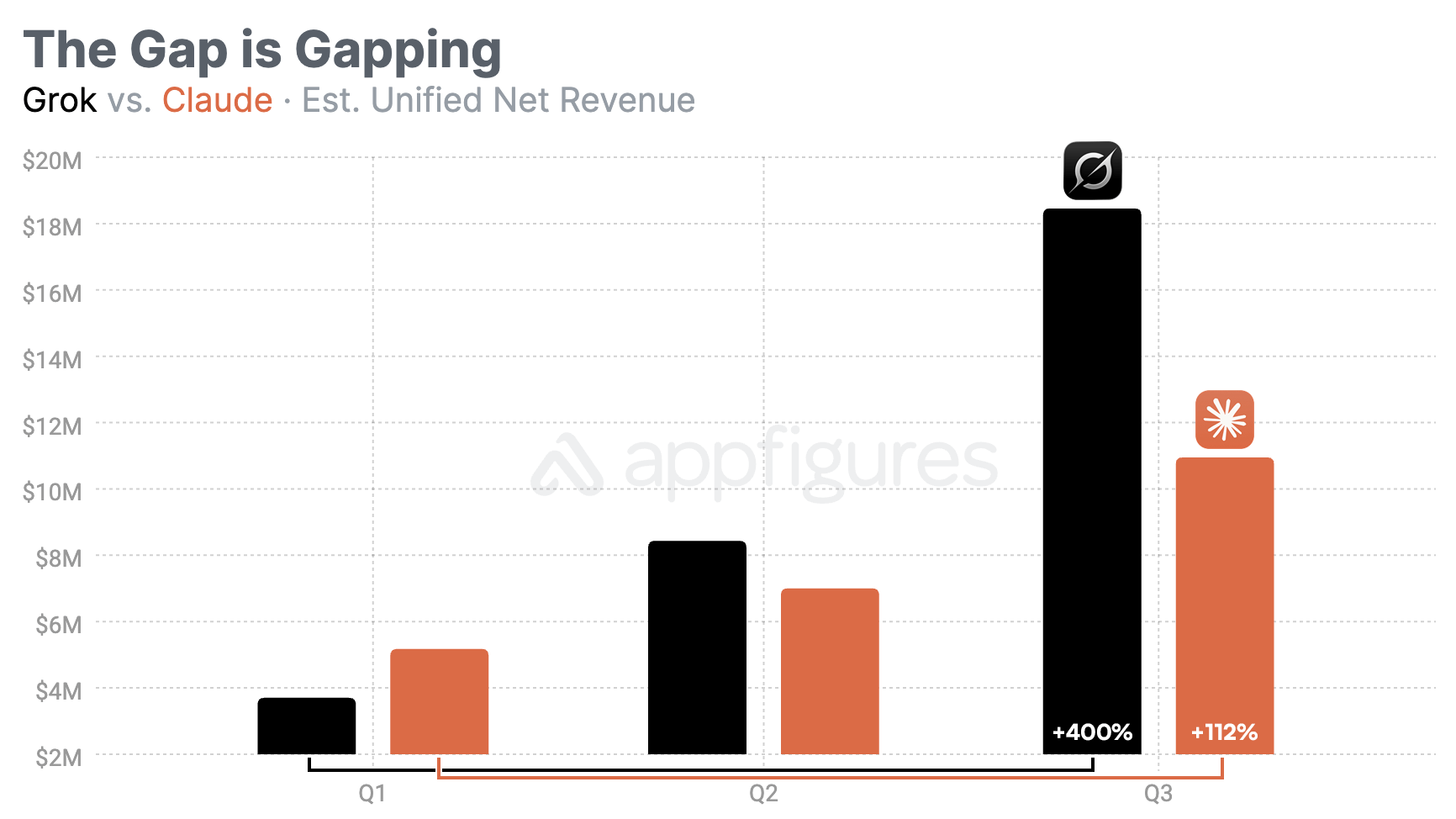

Although ChatGPT is the king of AI, the race itself is far from over, and the one that seems to be winning currently is Grok.

Grok and Claude are the most similar platforms in my mind to rival ChatGPT. Sure, there's Gemini, DeepSeek, Meta, and others, but Grok and Claude are the ones I hear about the most from non-tech friends. Well, mostly Grok and not Claude, and the numbers confirm it.

According to our estimates, Grok's mobile revenue rose 400% between Q1 and Q3, leading to 18.5M of net revenue in Q3. That's an incredible amount of growth for an app that launched in February, was technically available already within the X app, and wasn't even available on Android until a few months ago.

You could say it's politics that's propelling the growth, but I've looked at it enough to know it's also the features. Especially the generative side (Imagine), which contributed to revenue nearly doubling over the summer.

We saw that in September with Gemini, which delivered the best month of revenue for the app. Smaller overall at $1.3M estimated net revenue on the App Store, but its biggest since launch.

Claude doesn't have that... Anthropic's focus on software development is great, and updates to the agent have made Claude one of the funnest agents to talk to, but will its lack of generative AI hinder its adoption by the masses?

Only time will tell.

4. September Was a Mixed Month for Streamers - The Highest Earning Apps in the World

September is behind us, marking the end of the summer and almost always a drop in revenue "thanks" to back-to-school and back-to-work trends for many.

This September wasn't any different. Let's go through the list:

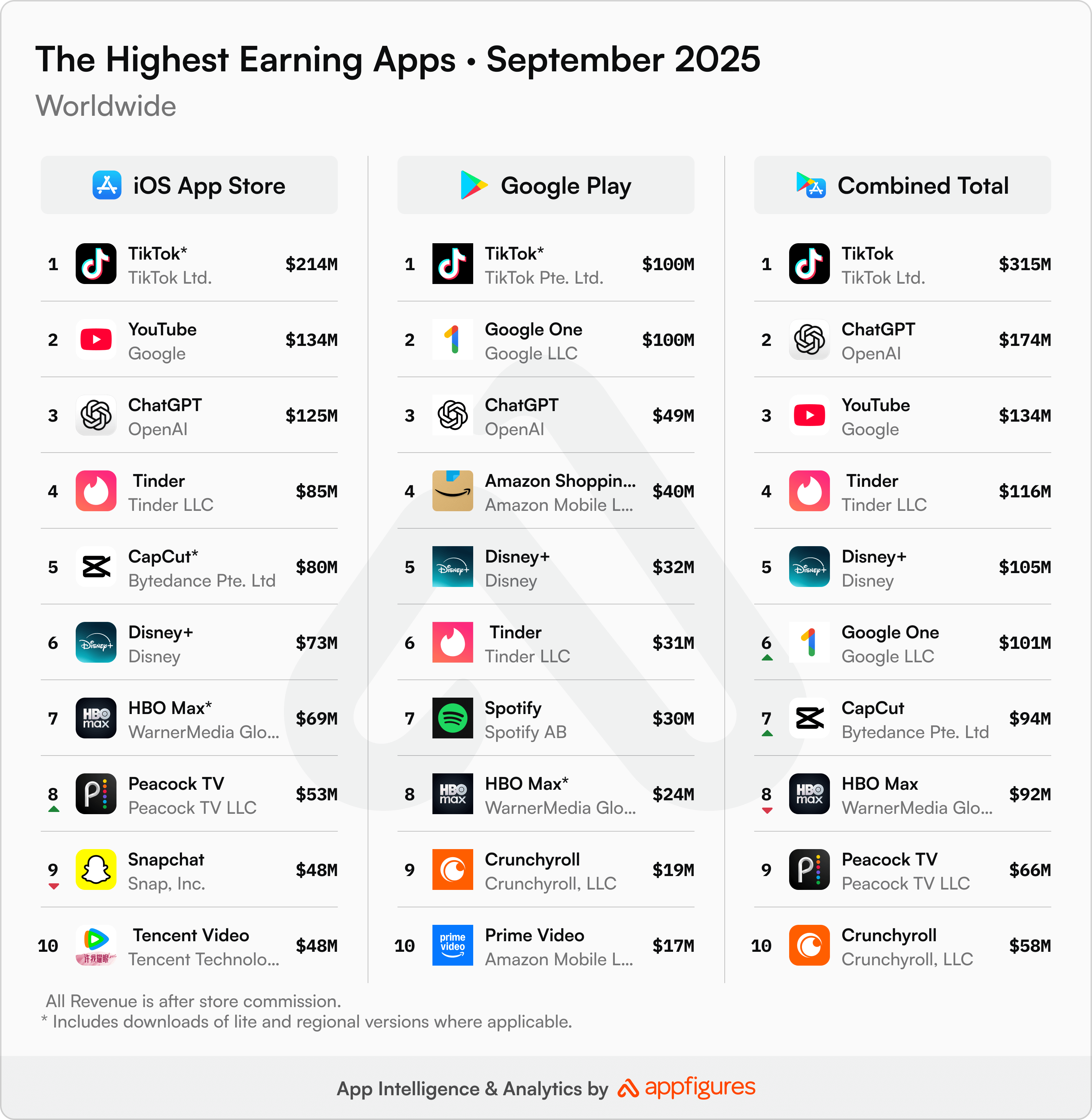

TikTok was, again, the highest-earning mobile app in the world, even though its after-fee revenue dropped 6% to $315M, according to our App Intelligence. The gap between TikTok's revenue and the next high earner is so wide that I don't expect to see it changing position any time soon, even after its US operations have moved away from ByteDance.

ChatGPT was the second-highest earning app in the world in September, raking in an estimated $174M of net revenue. That's a touch higher than August's haul, showing ChatGPT's resilience to stronger competition and a lukewarm reception to GPT 5.

YouTube, Tinder, and Disney+ round out the top five highest earners in the world. But unlike ChatGPT, all three have seen revenue drop. Considering they're all entertainment-focused, that makes sense, and they'll likely rebound in October.

All except for Disney+, which is having a bunch of problems...

CapCut, TikTok's video editor, inched up a spot in September on slightly higher revenue. That's great considering its target demographic has much less free time now. I've been following CapCut for a while now and its impact on the market continues to make waves. I don't expect that to end any time soon.

One more move that's worth noting is Peacock's. Not really a move as it stayed in 9th place, but unlike rivals Disney+ and HBO Max, Peacock's revenue actually grew in September thanks to good programming - content is still king.

The top 10 highest-earning apps collected $1.3B after fees, according to our App Intelligence, which is fairly similar to August's total. Considering September is usually a down month, this is good news for all developers.

Ready to Beat the Competition?

Appfigures has the intelligence you need

5. The AI Race Rages On! The Most Downloaded Apps in September

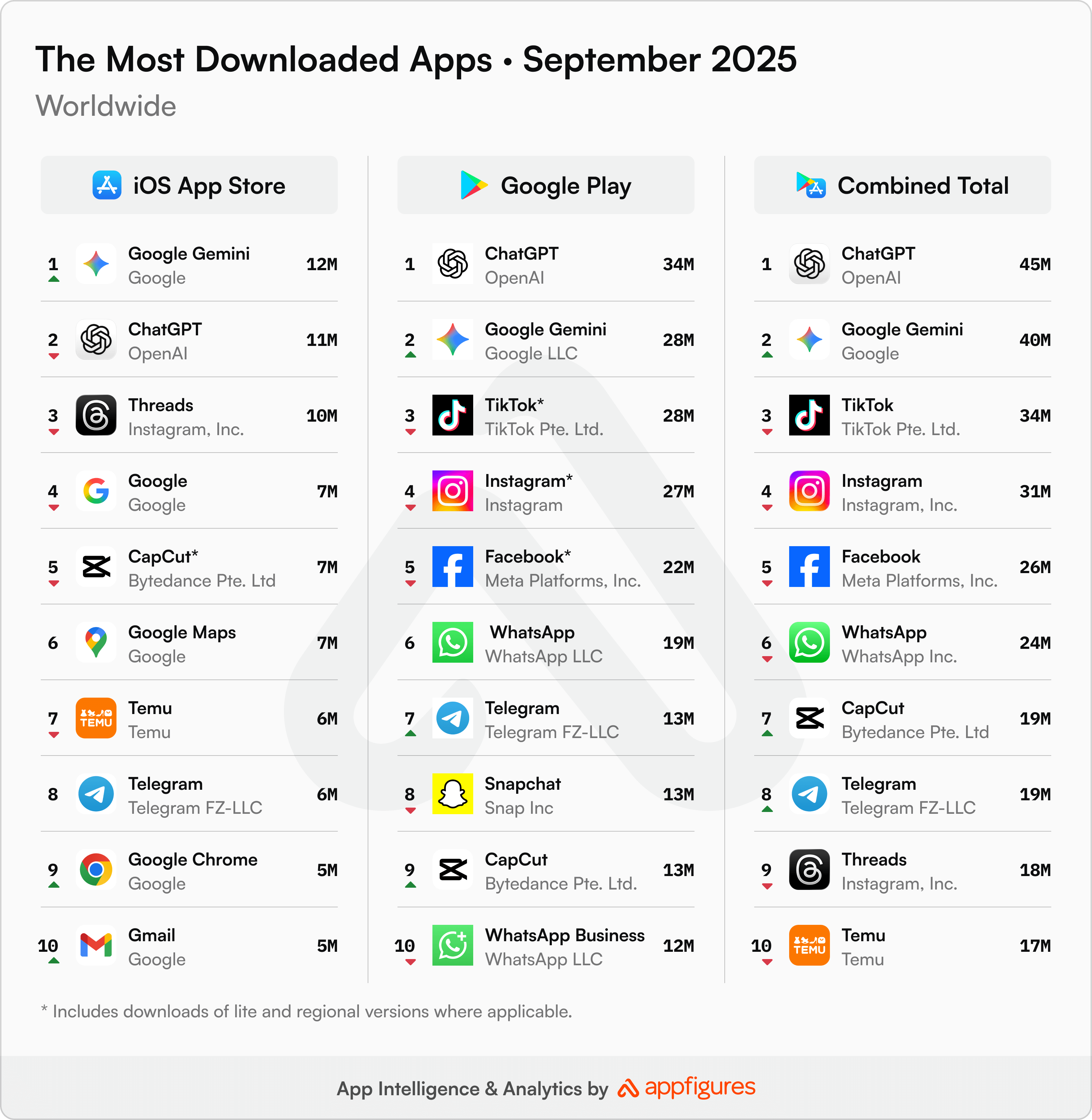

Google's Gemini was almost the most downloaded app in the world in September, turning the slow back-to-school month into a stage for its new generative AI capabilities.

But it wasn't. The crown went to ChatGPT.

ChatGPT was the most downloaded app in the world in September, making its way into 45M devices across the App Store and Google Play, according to Appfigures Intelligence.

Although a touch lower than August's haul, ChatGPT's growth continues to skyrocket in a way few apps have grown, leading the AI race but also paving the way for more mass-market adoption.

Gemini was close, with 40M estimated downloads in September coming mainly from Google Play. For context, Gemini saw 9M combined downloads in August, which wasn't enough to make the chart. We're only a few days into October and it's already at 7M downloads, so I suspect we'll see it again this month.

TikTok, Instagram, and Facebook round out the top five, and for the first time in a long time, the Meta trio (Insta, Facebook, and WhatsApp) didn't make the top 5. Gemini might lose steam, but if it doesn't, the trio's run might be over for good.

CapCut scored a small win in September, rising into the #7 spot, albeit with fewer downloads. But then again, its target demographic is a bit busier now, so that's understandable.

And lastly, Temu. Actually. Temu dropped four spots into the last spot in our list in September, shedding 23% of downloads likely due to reduced ad spend now that its margins have been forever slashed due to tariffs.

The top 10 most downloaded apps in the world saw 273M combined downloads in September, according to our estimates. Just as many as August, but with some of those shifting away from the big names.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.