This Week in Apps - Can't Stop the Music

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. Users Show AI for Music is Magical With Their Wallets

AI music has been mostly novelty — until now. Suno is producing songs that sound surprisingly real, the kind you'd actually want to listen to. It's a rare mix of tech and artistry that's starting to find an audience, and the numbers show it.

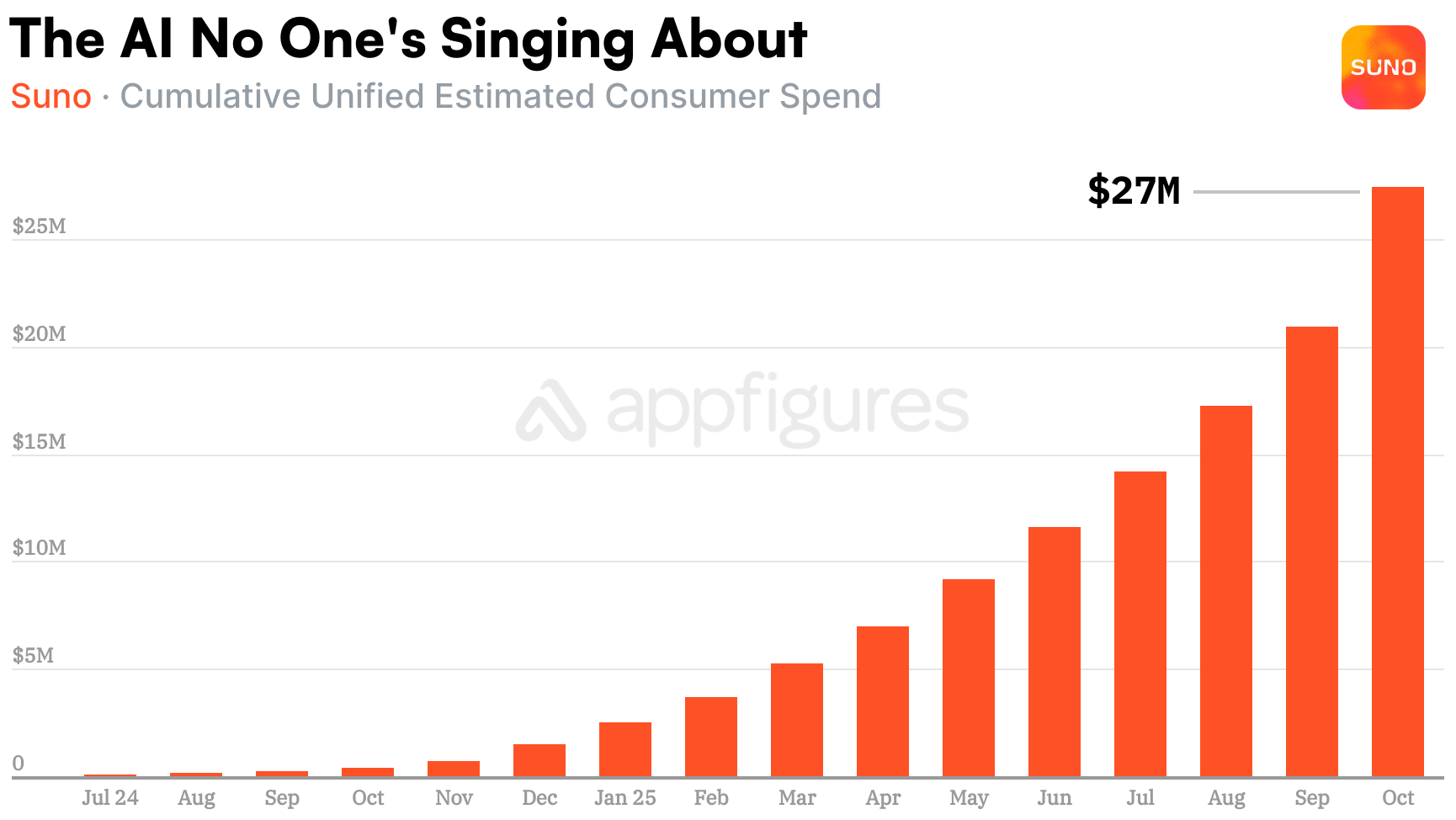

Suno launched its mobile app in July 2024, and since then, users have spent a total of $27M in gross revenue across the App Store and Google Play, according to our estimates.

That's real money for a brand new category.

The first few months were slow. Really slow. From July through December 2024, Suno was pulling in less than $1M per month. The app was finding its footing, testing pricing, and figuring out what users actually wanted.

Then something clicked in early 2025.

Starting in January, revenue began climbing steadily month over month. Not in spurts or viral spikes, but in a consistent upward curve that screams product-market fit. By the summer, that climb turned into a steep ascent.

According to our estimates, users gave Suno $7M in October alone, more than double what it made just a few months earlier. That's the kind of acceleration that means Suno isn't just a gimmick.

What makes Suno's trajectory interesting is what it's not. It's not a TikTok-fueled download spike that fades in a week. It's not a celebrity endorsement or a massive ad campaign.

This is sustained growth driven by users who keep paying month after month. The revenue curve from July 2024 to October 2025 is almost textbook for a subscription app that's nailed retention and is adding new subscribers consistently.

Interesting question: is Suno a consumer app or a creator tool? I think it's both. While the reality of AI-generated music is still murky, I can see it succeeding with both a new generation of producers as well as consumers who want novel/personalized music. Both spell big money for Suno and a brand new category for competitors to enter.

This engagement is probably why OpenAI announced it's also working on a text-based music generator.

2. Mainstream Dating Apps Hit New All-Time Highs for the First Time in a Long Time

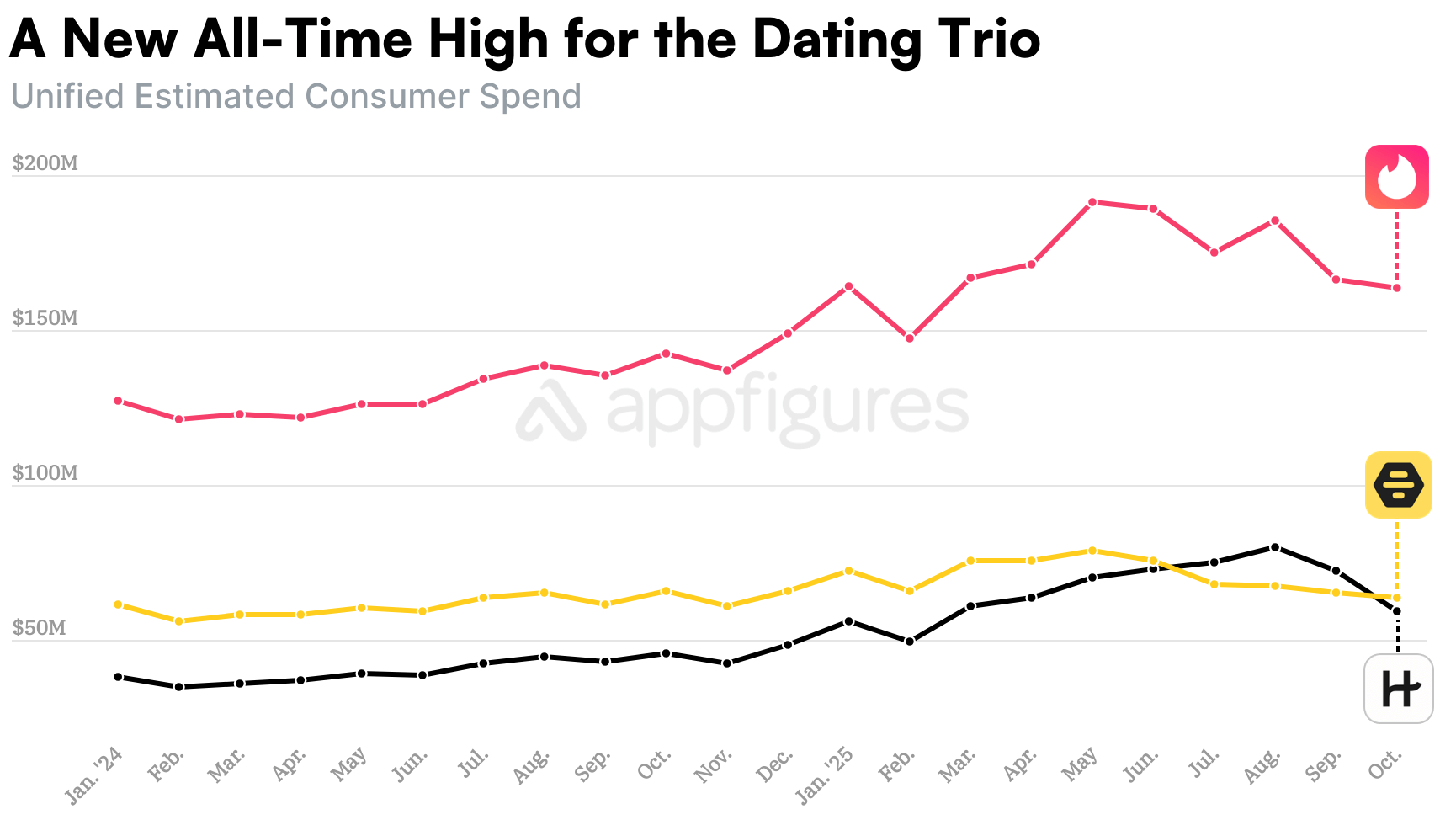

The dating app charts have been pretty predictable for years: Tinder → Bumble → Hinge. To my surprise, that changed this summer. And that happened right after all three hit a new all-time revenue high.

And we're talking a lot of money!

I started out by looking at the niche dating apps to see if their growth rate changed, and it didn't. I started with the niche dating apps because it's common knowledge at this point that the top three are holding steady.

But that wasn't the case. A combination of Bumble slowing down and Hinge pushing harder flipped their positions, putting Hinge on top for three consecutive months.

According to our estimates, Bumble's gross revenue from the App Store and Google Play dropped a whopping 20%, roughly $16M, since hitting an all-time high in May. Hinge's revenue nearly matched Bumble's in June, then beat it in July, August, and September.

I looked all the way back to 2020 and this is the first time that happened.

Hinge's push ended and its revenue dropped in October down a smidge below Bumble's - $41M vs. $44M before fees, according to Appfigures Intelligence.

Category leader Tinder continued its slow growth this year. Like Bumble, it hit an all-time high in May, reaching $134M before fees, according to our App Intelligence, for the first time ever.

We estimate that users spent a whopping $340M across the trio in May, the most we've ever seen in a single month and it's not even cuffing season yet.

Bumble's app revenue decline aligns almost with its battered stock price, which has lost over 30% this year and has been on a downward slope since the summer. And while that's continuing, I expect to see Hinge try harder. If not, they should.

See Appfigures In Action

Better intelligence to beat the competition faster!

3. Kick's Relaxed Moderation Leads to a 37% Increase in Monthly Revenue

A few weeks ago, an app I didn't recognize rose to the top of the US charts.

Kick, a Twitch competitor from Australia, peaked at #3 on Sunday, October 19th, seemingly out of nowhere. It didn't go viral on TikTok. It didn't run a massive paid ad campaign. It wasn't even ASO.

It was Westcol.

Kick, in case you're like me and haven't heard about it, is a streaming platform that competes with Amazon's Twitch, but with much lower fees (5% vs 50%) and more relaxed moderation, especially around gambling which Twitch doesn't allow and Kick welcomes.

According to Appfigures Intelligence, Kick's downloads were higher that entire weekend, but more than tripled on the 19th to 262K, the most the app has ever seen in a single day. For reference, the last peak came in at the end of 2024.

The spike, which started the Friday before and went back to normal a week later, drove about a million new downloads for Kick, according to our estimates. That's more than twice the downloads it saw the prior week.

Westcol?

Based on my research, the spike was a result of several events that took place that weekend, but primarily a stream that broke the record for most viewers - 1.6M. That was a stream from a creator called Westcol who talks about boxing and is now one of Kick's most followed creators.

Westcol matters to Kick because he left Twitch for being too strict in its moderation, showing the benefits of Kick's more relaxed moderation to some creators, and helped grow Kick's popularity among Spanish-speaking users.

Where's the Money?

Did the downloads spike cause a revenue spike? No, but Kick didn't need it!

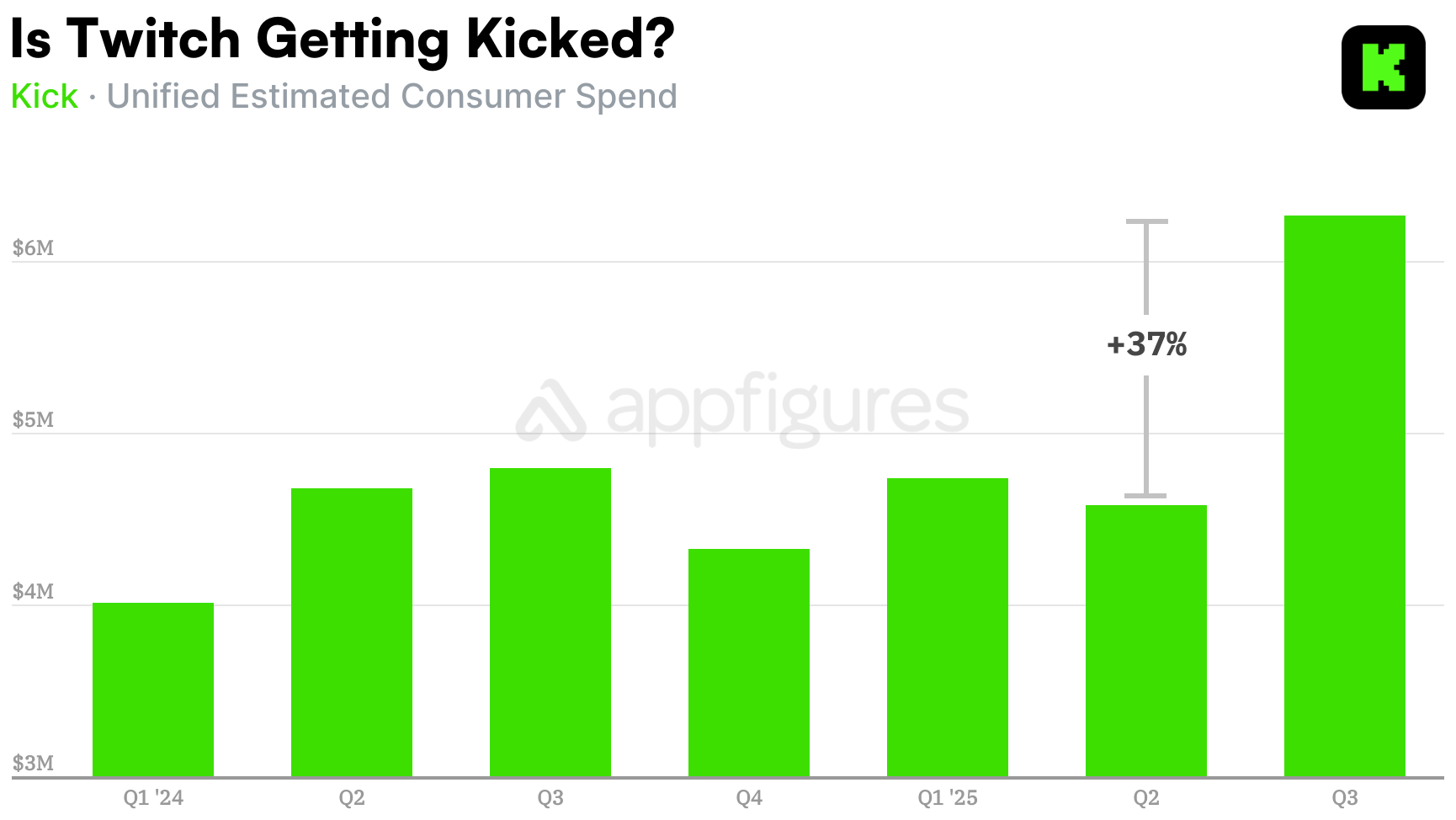

Kick's quarterly app revenue growth has been somewhat flat, ebbing and flowing around the $4.5M (pre-fees) since 2024, according to Appfigures Intelligence. However, things changed this summer as Kick has been gaining momentum thanks to the company making aggressive deals to get big names on the platform.

Our estimates show users have spent $6.3M in the app in Q3, by far the most the platform has ever seen.

Over the last few years it's become obvious that catering to creators is a winning strategy. Kick's creator-first approach and increasing popularity are sure to change the market Twitch once dominated. The only question is how.

4. Snapchat's Revenue is Still Growing - October Was the Best Month Ever!

Snapchat just had its biggest month of revenue ever!

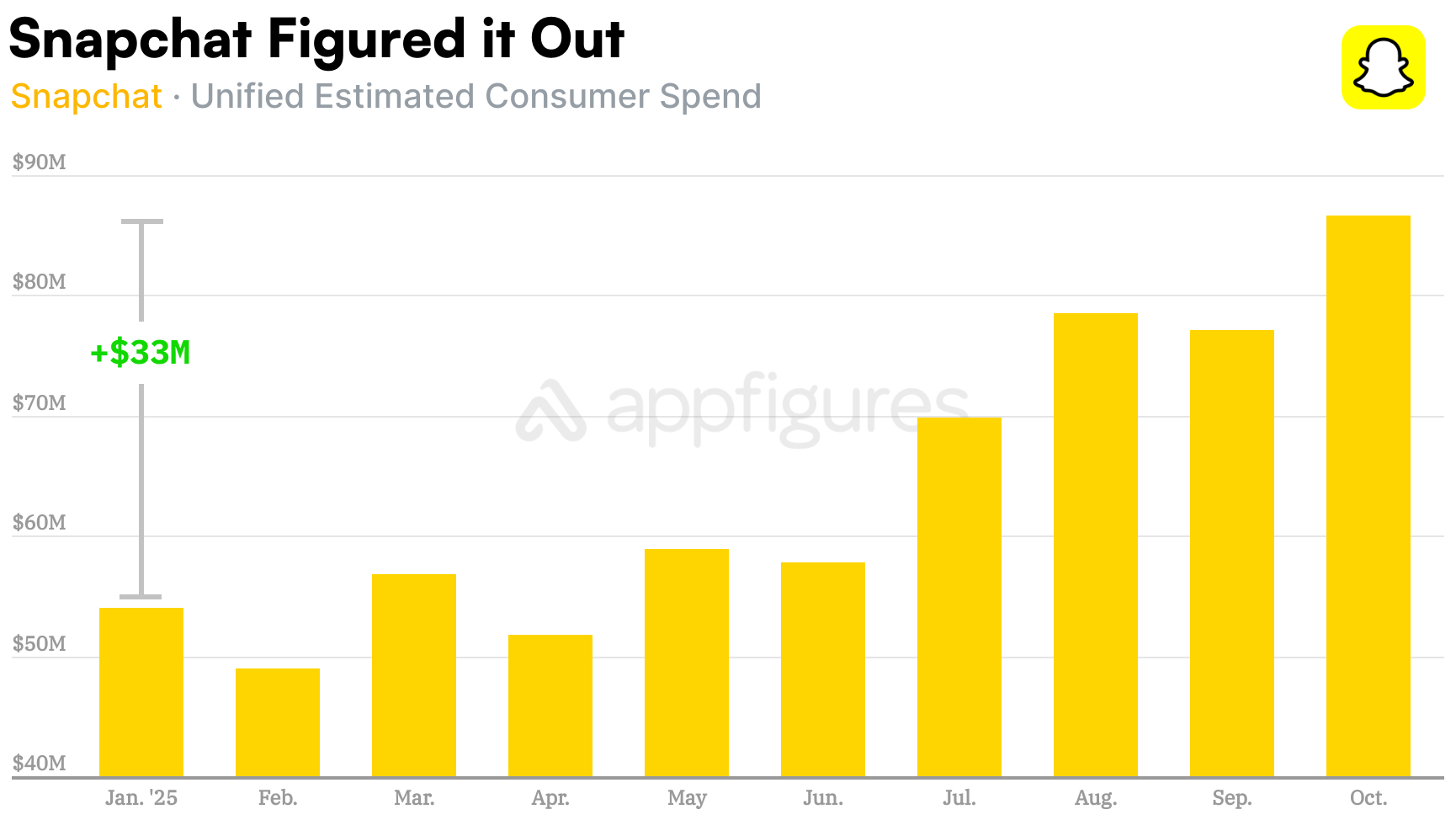

I've been following the app's revenue journey since Snap started offering a premium tier back in the summer of 2022, and for the most part it has been growing steadily month over month. What we're seeing in the last few months, however is much faster growth and much bigger numbers.

In an era where TikTok is stealing most eyeballs, Snap is still finding new ways to monetize attention.

Let's jump right into the data! According to Appfigures Intelligence, Snapchat saw $87M in consumer spend (revenue before store fees) in October. That's a 10% increase over its previous peak which came in August.

Looking at the revenue estimates for the entire year, October's gross revenue was $33M higher than January's haul. Last year, Snapchat also had a big October but not as big. Our intelligence shows the Oct vs Jan diff was $23M in 2024, a full $10M less.

Snapchat's revenue continues to grow and beat other social platforms. Not bad for an app that'll turn 15 next summer.

Wait, how?

Back in 2022 when Snapchat+ was released, its features were pretty basic and I said something along the lines of "this just isn't enough to get users paying". The folks at Snap took a while to figure out what was enough, enduring a few months of revenue drops after launch, but eventually settled into a good rhythm of updates that users seem to like.

2025 saw a barrage of additions revolving around customization, including additions like movie posters, even shorter snaps, and AI generators.

Oh, it also pulled a CapCut by limiting storage for free users and charging for it instead. It was a great addition.

The team at Snap figured out what gets their users excited and they're actively refining that. I expect to see revenue continuing to grow faster, and hope other platforms (ahem ahem, X) take note.

Ready to Beat the Competition?

Appfigures has the intelligence you need

5. Four Months In, How's ElevenLabs' AI Voice Changer Doing?

AI can write, code, and draw, and with ElevenLabs, it's finding its voice.

Arguably the most realistic voice generator, ElevenLabs wrapped a mobile app around its API a few months ago and released a powerful voice generator for creators.

The app had a great release day in terms of downloads, but considering there's nothing else like it, it would need to invent a new niche in order to really succeed.

Now, four months later, I was curious if it did.

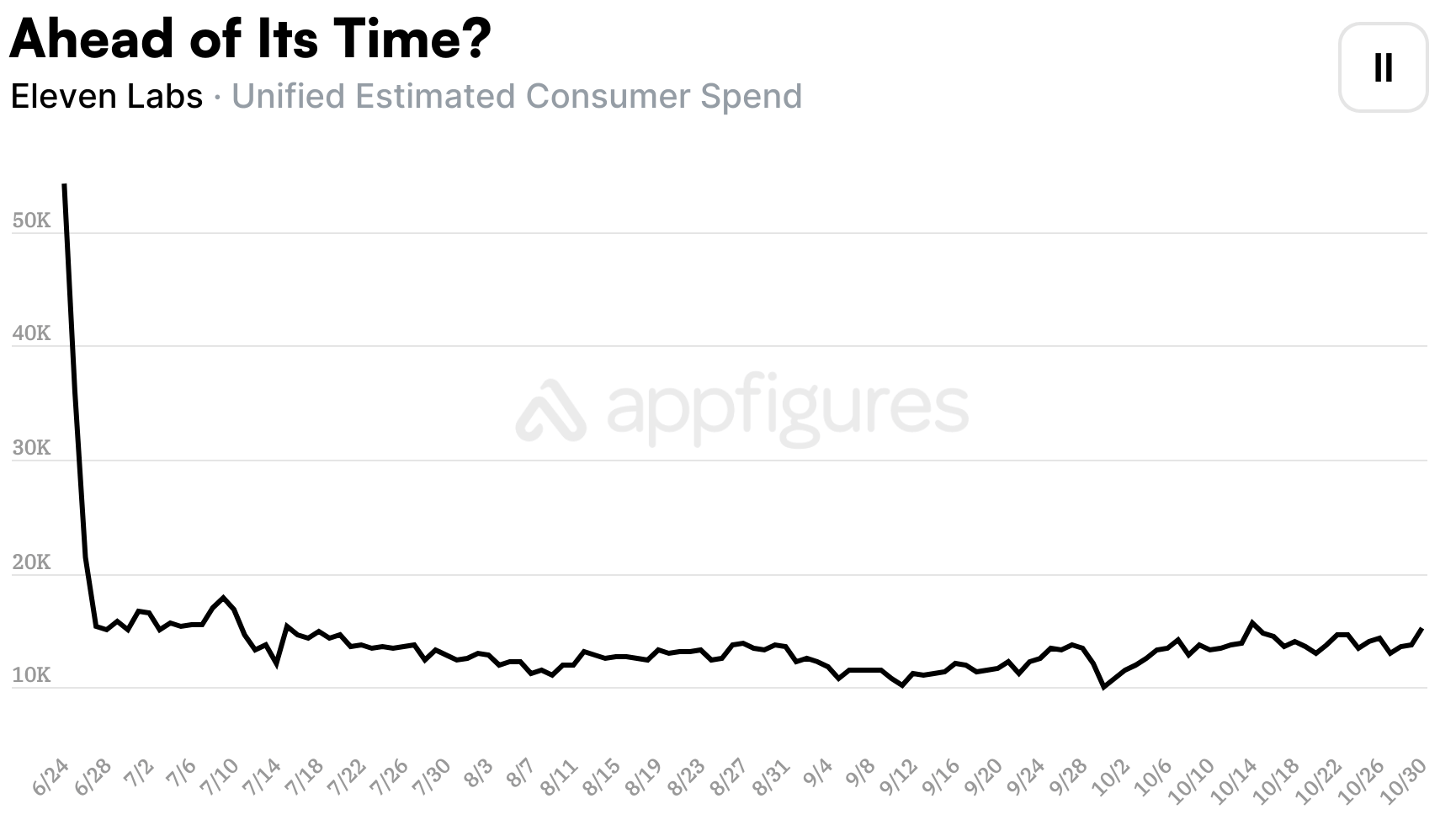

Looking at the downloads, the first obvious thing is that launch-day downloads didn't stick. Appfigures Intelligence shows 54K estimated downloads on launch day.

Downloads dropped sharply and stabilized after a few days at what eventually became the app's new steady-state of roughly 14K daily downloads. And that's where downloads have been hovering since.

That steady-state added up to 1.8M downloads since release, according to our estimates. What's interesting is that more than half of that total came from Google Play.

I didn't expect that at all so I kept digging and noticed that a big chunk of the downloads from Google Play didn't come from English-speaking countries.

The US ranked 6th in downloads on Google Play. India, Pakistan, Brazil, Indonesia, and Mexico outranked it, driving more than 64% of the downloads. I didn't expect that.

Did ElevenLabs Create a New Category?

With almost 2M downloads for an app not meant for the mass market, I think ElevenLabs managed to create a new niche. But I don't know that it's the niche it expected.

ElevenLabs positioned itself as a tool for creators, much like CapCut and other video editors. However, unlike video editing, not all creators need to change their voice. Quite the opposite in some cases.

But given that the majority of revenue for creators comes from English-speaking countries, it could be that ElevenLabs is helping those who don't speak the language, or don't like the way they sound, to find a new voice.

It's a small but interesting niche, but we won't know if it's real until ElevenLabs starts charging in-app.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.