This Week in Apps - It's Peacock Time

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. How Peacock Became the Streaming Underdog That Could

The streaming wars have entered their chaos era. Disney is locked in a standoff with Apple that's blocking many from signing up. HBO panicked and changed its name again this year. And apps from China nobody's heard of are quietly crushing every traditional streamer in the US.

But the most shocking development? NBC's Peacock, the service some thought was too late to the game, is about to dethrone HBO Max as the highest-earning mobile streaming platform in the US.

The Old Guard Is Crumbling

When the year started, HBO Max and Disney+ ruled the streaming landscape. Peacock and Paramount+ were behind, fighting for visibility. That world is gone.

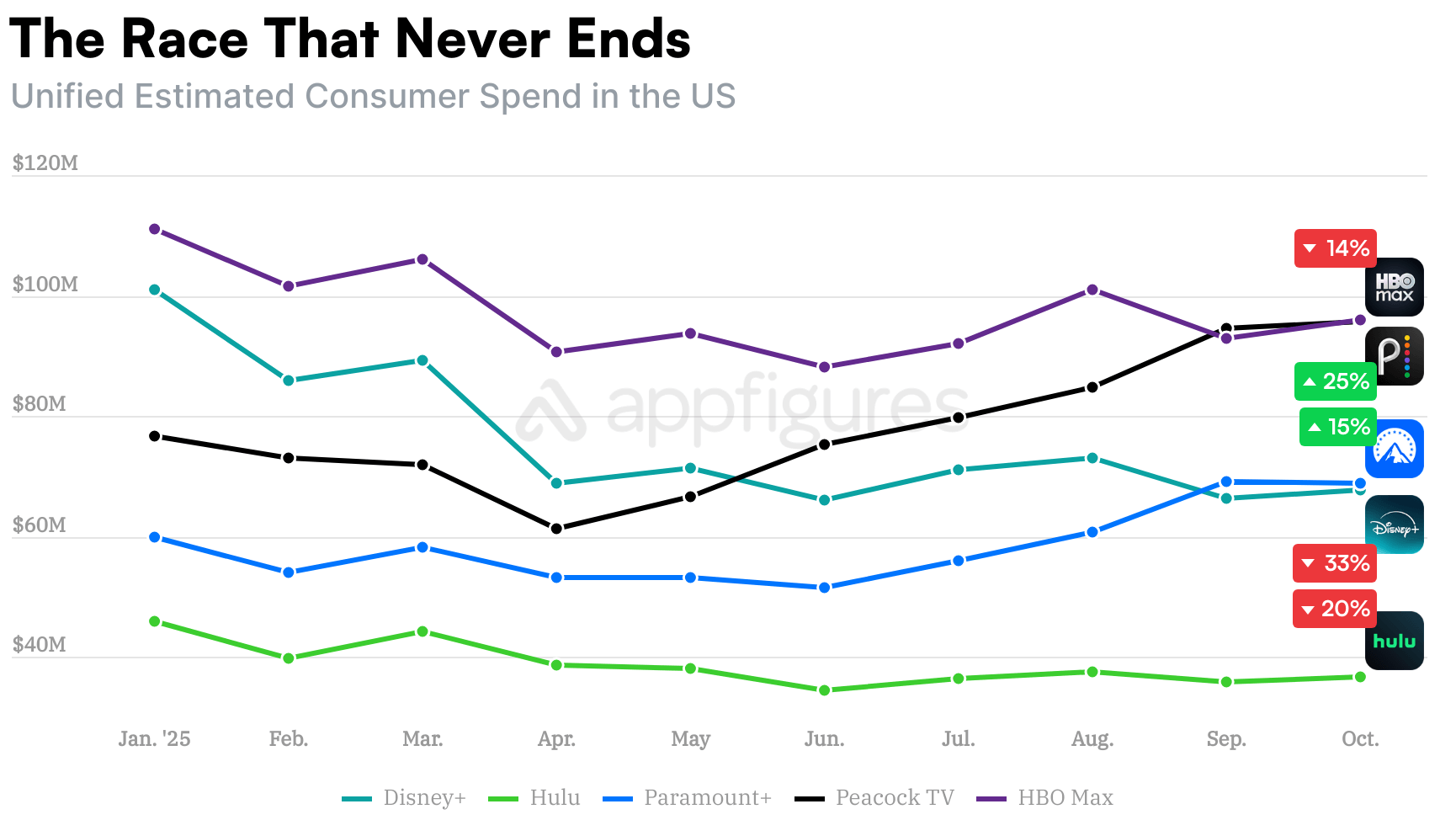

Using Appfigures Intelligence, I tracked revenue for the five major U.S. streamers: HBO Max, Disney+, Peacock, Paramount+, and Hulu, and the results tell a story of spectacular collapse and unlikely triumph.

HBO Max, which started 2025 as "Max" before reclaiming its HBO branding this summer, has hemorrhaged 14% of its revenue this year. The prestige play isn't working anymore. Meanwhile, Peacock has surged 25% and is now just a few subscribers away from claiming the top spot.

I didn't have "Peacock beats HBO in the US" on my 2025 bingo card. I don't think anyone really did.

Disney's Self-Inflicted Wound

The second battle is even stranger: Paramount+ has outpaced Disney+ in the US.

For two straight months, Paramount+, the service nyou don't hear about often, has outearned Disney's flagship streamer. Disney+ revenue has cratered 33% this year, largely "thanks" to the company's baffling decision to stop accepting new App Store subscribers in protest of Apple's fees.

The move was meant to send a message about corporate power. What it actually did was gift subscribers to competitors. You'd expect Disney's out-of-app-store subscription process to be extra optimized, but I went through it recently and can tell you it isn't. There's room for improvement.

Why Peacock Is Winning

NBC went all-in on a strategy that seems obvious in hindsight: give people what they actually want to watch. Live sports. Addictive reality TV like Love Island. Comfort-food reruns. It's not prestige TV or Marvel spectacle but rather what keeps people coming back.

And it's working! Not just in revenue, but in downloads too. Peacock's downloads are very close to HBO's so far this year and that's never happened before.

The Bigger Picture

Above all this industry drama sits a quieter revolution I've been talking about since 2023: short drama apps from China are outpacing traditional Western streamers in new downloads.

The streaming wars were supposed to be about which Hollywood giant would win. Instead, we're watching NBC's underdog service beat HBO's prestige machine while short drama apps from overseas rewrite the rules entirely.

In other words: it's chaos, and nobody knows what happens next. But right now? It's Peacock time.

2. Etsy's Marketplace Has how Many Sellers???

How many sellers do you think are on Etsy?

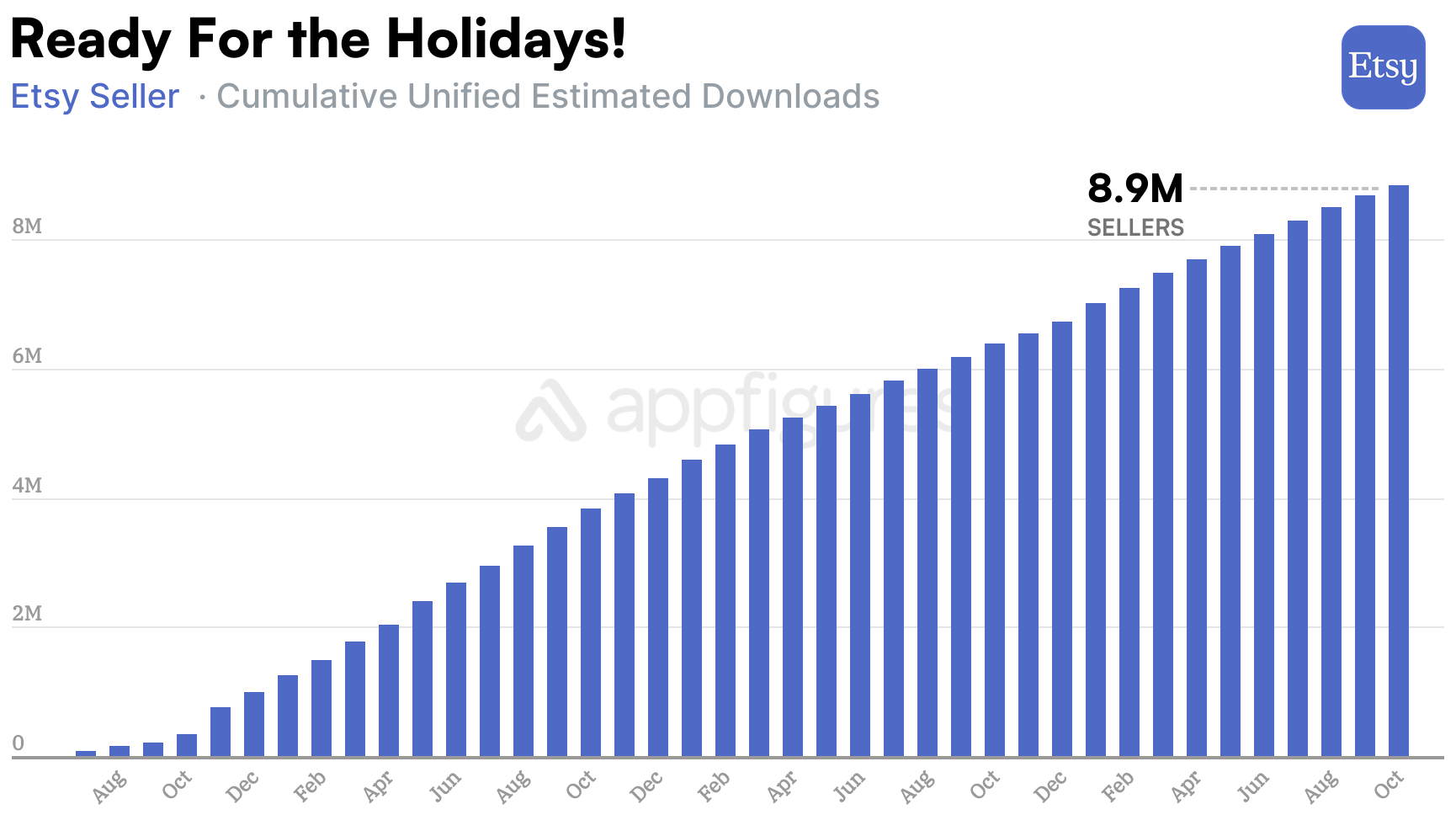

I recently discovered Etsy's sellers app, and if you've been following the newsletter for long enough, you know how much I love to use this type of app, the kind that you have to download to do something, as a proxy for real-world performance.

Etsy Seller is a pretty comprehensive app for sellers to manage most of the things about their store, listings, promotions, and even ads. While I imagine some sellers don't have the app, I doubt that number is high considering its value and that it's available for both iOS and Android.

The app was released in the summer of 2022 and received a lot of downloads in the first few months, most likely from existing sellers. According to Appfigures Intelligence, Etsy Seller was downloaded 2.7M times in its first 12 months of availability.

The downloads eventually stabilized as most existing sellers got their hands on the app making subsequent months of downloads more of a proxy to how the marketplace is growing.

According to our estimates, the app was downloaded 2.4M times in 2024, not far off the first 12 months, and 2.2M times in the first 10 months of 2025.

I expected the rate would drop after Etsy changed its stance on selling 3D printed goods earlier this summer, but the data doesn't agree. Downloads continued on trend.

In total, our estimates show the app was downloaded 9M times since release with a smidge more downloads coming from the App Store than Google Play.

I knew Etsy's marketplace was big, but this is far more than I expected. Now keep in mind, I'm using downloads to estimate sellers which isn't perfect so I might be off. I couldn't find (m)any numbers to compare to, but I was able to find a tracker from Marketplace Pulse that estimates the number of active sellers to be 5.4M active as of Q2 2025, which sounds about right considering not all sellers succeed.

The variety Etsy offers along side its well-established brand are what makes Etsy so hard to compete with, and similar to the App Store and Google Play, a business-maker for those not selling code.

See Appfigures In Action

Better intelligence to beat the competition faster!

3. Can X Outdo Its Last Black Friday Campaign? It Needs To!

I forgot to check in on X's revenue last month. Too many interesting trends and not enough newsletters. So in this one I'll cover two months + look to the future because November could be a special month for the platform.

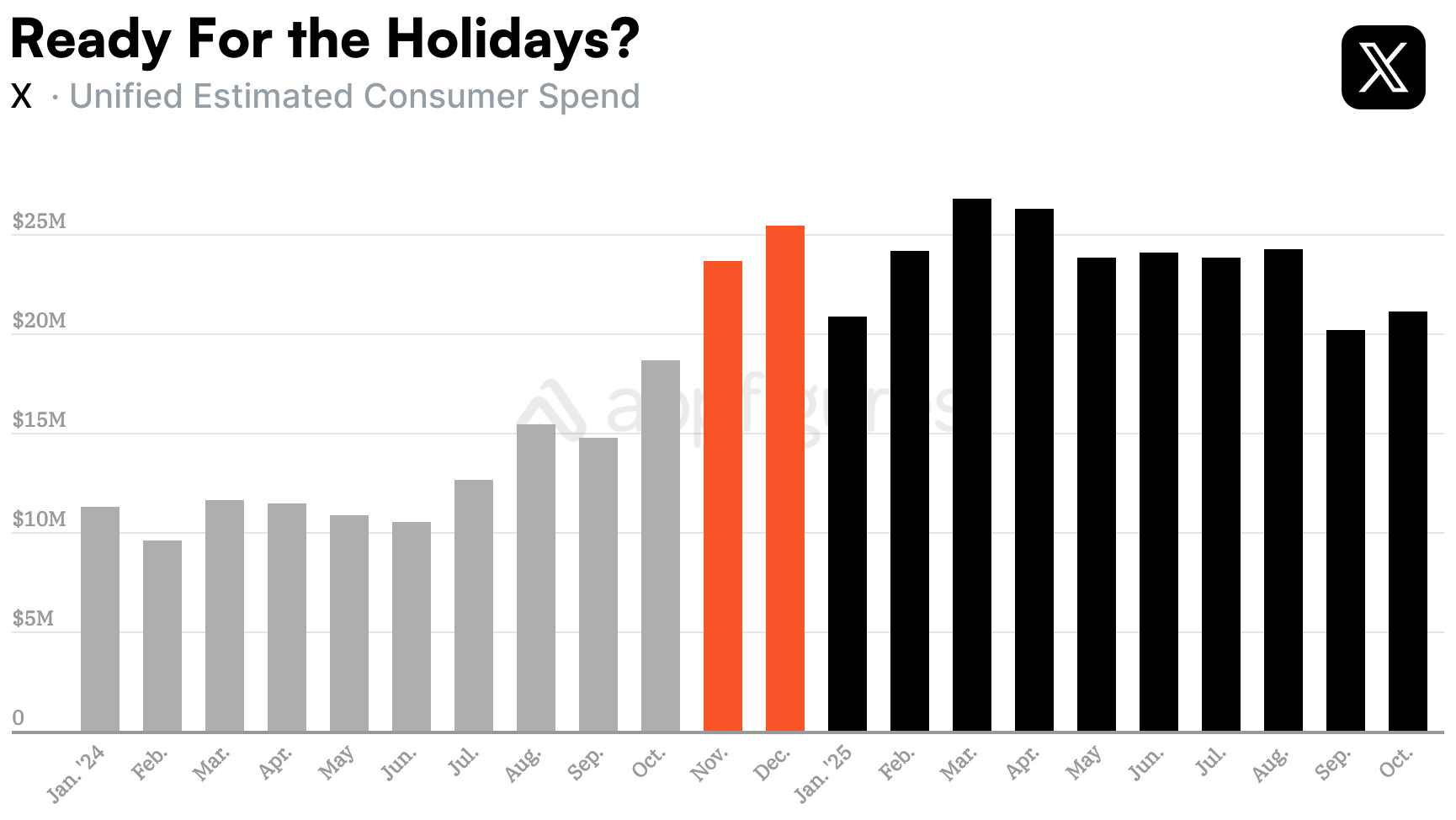

X's Black Friday campaign last year was a positive surprise that worked very well, but before we get into what that could mean this year let's start with the numbers.

According to Appfigures Intelligence, consumer spend in X was $20M in September and $21M in October. This is significantly higher than revenue in 2024, which we estimate to be $14M in September of 2024 and $19M in October. All of these amounts are before fees (what users paid).

That's good growth. Nothing to brag about, but we're also talking about an increase of several millions.

But...

When compared to previous months, it's actually a massive decline.

When you look at the trend, September was actually X's lowest month of revenue in 2025. October ranked third from the bottom. All the way at the top of the list was March, which drew $27M in consumer spending.

I suspect the drop we're seeing is a result of natural churn combined with Grok-only subscriptions happening on the Grok app and new subscribers holding off until the Black Friday promotion lands in a few weeks.

The Black Friday Effect

Black Friday promotions are a great way to get subscribers, which is why we'll have a very sweet offer on Appfigures Intelligence soon, but they also alter the economics for the entire month. I know this from experience.

I don't know if X will run a Black Friday campaign this year, but if they do, based on the growth from the last year, I expect it to drive revenue to an all-time high, beating March's $27M estimate by roughly $2M. All before fees.

4. Spending Warmed Up in October – The Highest-Earning Mobile Games in the World

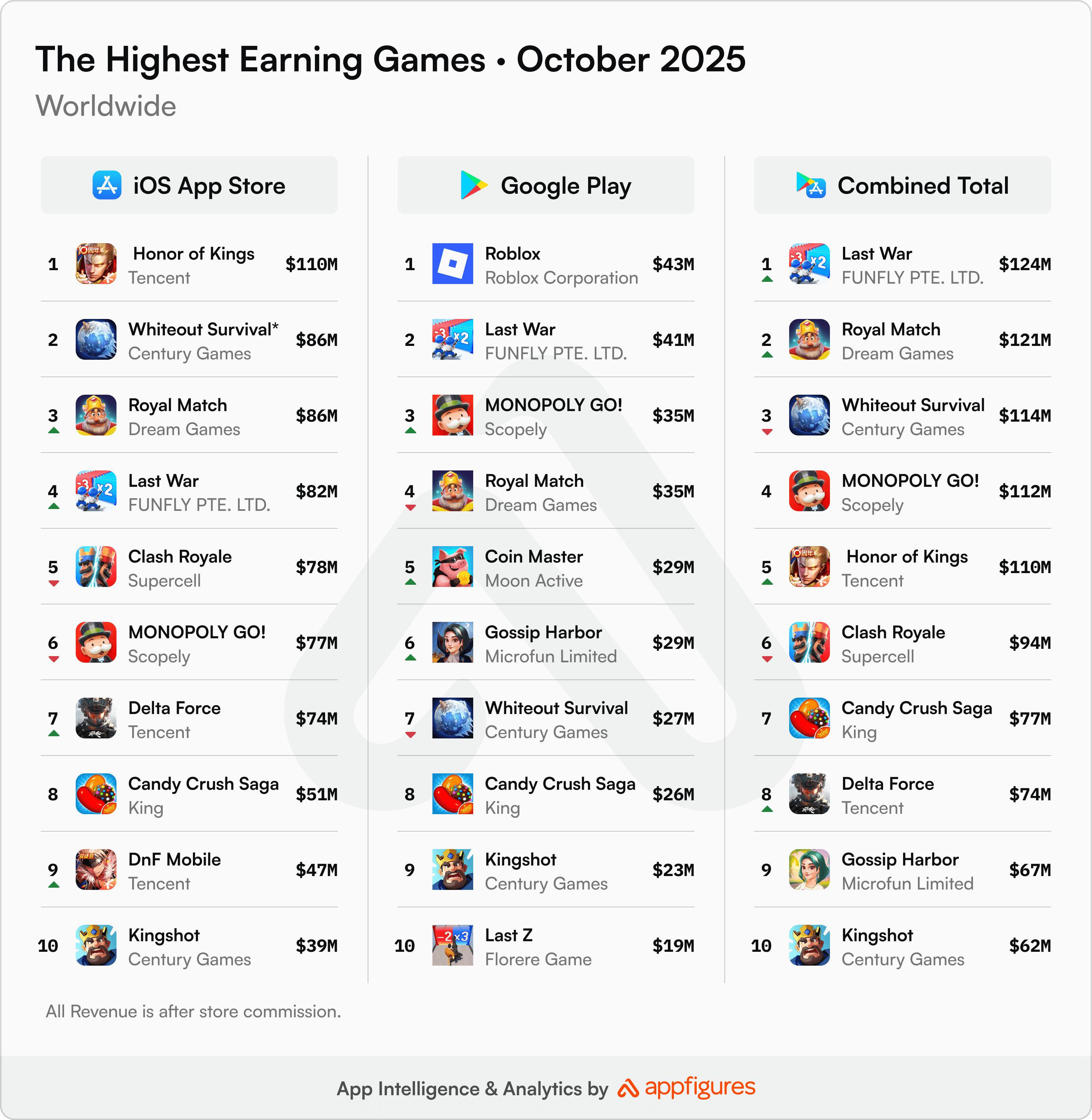

Good news for game developers: October showed signs of recovery for revenue, as player spending rebounded from September's post-vacation dip. The overall tone of the charts? Stability + with a few swaps at the top.

Last War from FunPlus regained its footing, rising back to #1 with $124M in net revenue across both stores, according to our App Intelligence. Royal Match followed right behind at $121M, continuing its steady climb with another strong month outside of Asia.

Whiteout Survival fell to #3 with $114M, and Monopoly GO! slipped one spot to #4 despite holding above the $110M mark. Tencent’s Honor of Kings completed the top five, driven largely by its iOS dominance in China.

Clash Royale landed in #6 with $94M, its first dip in several months, while Candy Crush Saga and Delta Force filled out the middle with consistent returns. Newer narrative titles like Gossip Harbor kept their momentum, finishing #9, and Kingshot held steady at #10. Across the board, the leaders held their ground even as competition tightened in the mid-tier ranks.

The world's 10 highest-earning mobile games generated $955M in net revenue last month, according to Appfigures Intelligence. That's a decent 7% month-over-month increase. We're now at three straight months below the $1B mark, but October suggests players are ready to spend again. Just in time for the year-end rush.

Ready to Beat the Competition?

Appfigures has the intelligence you need

5. Back on the Rise – The Most Downloaded Mobile Games in the World

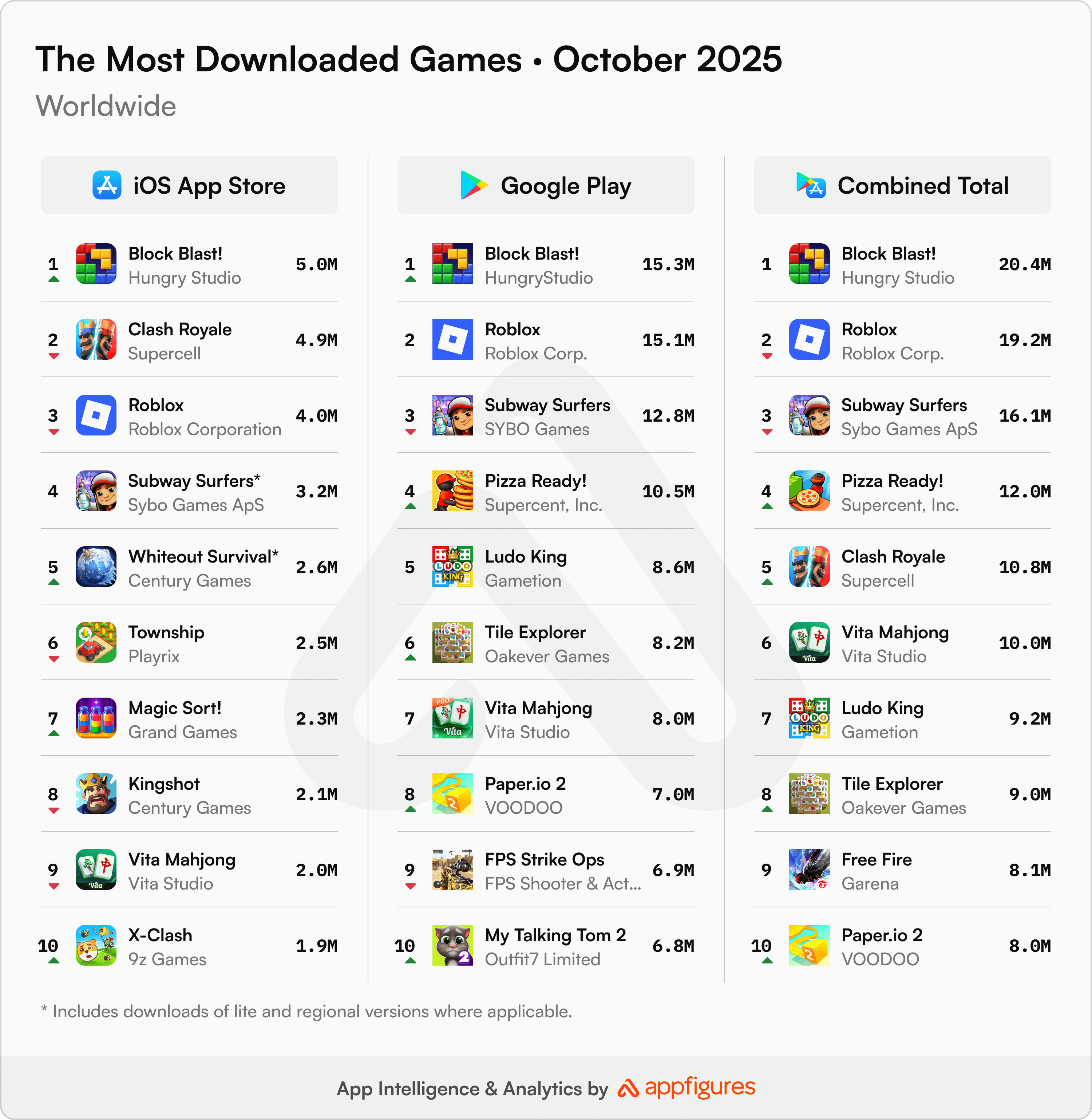

After a slower September, downloads picked up again in October, and puzzle fans led the charge.

The month's rankings saw a return to form for the world's biggest hits, with the chart looking largely familiar. But that doesn't mean it was quiet.

Block Blast! reclaimed the global crown with 20.4M downloads across iOS and Google Play, its strongest month since summer, according to our App Intelligence.

Roblox, which held the #1 spot in September, slipped just a smidge to #2 with 19.2M estimated downloads, while the evergreen Subway Surfers kept the race tight at #3 with 16.1M downloads. Pizza Ready! and Clash Royale rounded out the top five, holding steady with sustained player interest.

Further down, Vita Mahjong continued to rise, climbing again to #6 with about 10M downloads, followed by long-time favorites Ludo King (#7) and Tile Explorer (#8). Free Fire and Paper.io 2 closed the list, proof that hyper-casuals and battle royales still draw in the masses.

Altogether, the world's 10 most downloaded mobile games totaled 123M downloads in October, according to Appfigures Intelligence. A 9% increase month over month from September's haul. That bounce hints that the post-summer lull is fading and that familiar names are back to driving momentum as the holidays approach.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.